Your Student loan repayment tax return images are available in this site. Student loan repayment tax return are a topic that is being searched for and liked by netizens today. You can Download the Student loan repayment tax return files here. Get all royalty-free photos and vectors.

If you’re looking for student loan repayment tax return images information related to the student loan repayment tax return interest, you have pay a visit to the ideal blog. Our site always provides you with hints for downloading the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

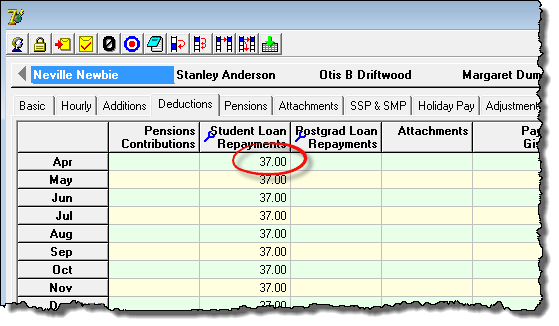

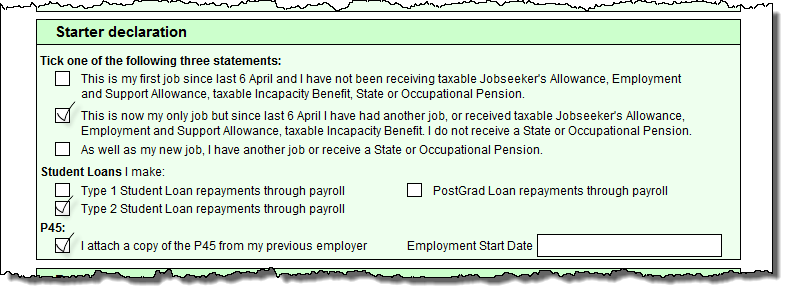

Student Loan Repayment Tax Return. If that spouse files a tax return as married filing separately the monthly ICR payment could be as low as 25 per month. Understanding Non-Refundable Tax Credits. For any SL types the percentage is 9 for PGL it is 6. According to the IRSs latest tax rules any student loan forgiveness benefits that you receive will need to be declared on your IRS tax return and will be counted against your taxable income for the year meaning that they will add to your eventual tax bill.

Will Student Loans Take My Tax Refund During Covid 19 2021

Will Student Loans Take My Tax Refund During Covid 19 2021

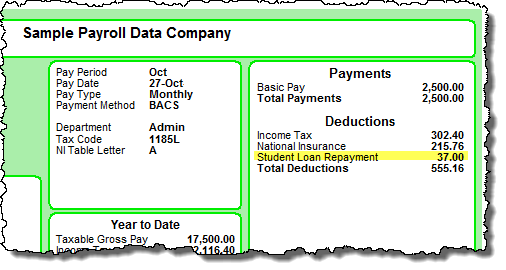

The Revenue Procedure provides relief when the federal loans are discharged by the Department of Education under the Closed School or Defense to Repayment discharge process or where the private loans are discharged based on settlements of certain types of legal causes of action against nonprofit or other for-profit schools and certain private lenders. The tax difference between MFJ and MFS with no children is attributable to the deduction for student loan interest on the MFJ return which is not allowed when MFS and the difference in. This section is accessed via the data input tab within the tax return and is used to indicate that the tax payer is eligible to make Student Loan repayments. The calculated repayment amount will be a percentage of all net adjusted income above a threshold. Your loan repayment will be frozen until at least September 2021 any wages or taxes garnished since March 2020 will likely be returned at some point your. Understanding Non-Refundable Tax Credits.

The calculated repayment amount will be a percentage of all net adjusted income above a threshold.

You pay back 9 of your income over the Plan 1 threshold 382 a week or 1657 a month. Taxfiler will calculate the repayments due and will ensure that repayments are only included in the tax computation if the income is above the statutory repayment threshold for the tax year. You pay back 9 of your income over the Plan 1 threshold 382 a week or 1657 a month. The calculated repayment amount will be a percentage of all net adjusted income above a threshold. The non-refundable tax credits are designed to reduce your federal tax liability to zero taxes. 8 satır When filling in your tax return you will need to include the total of any student loan.

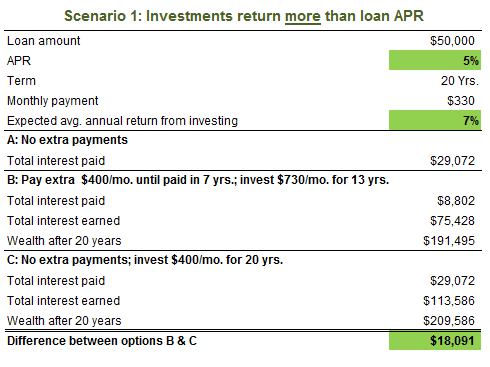

Taxfiler will calculate the repayments due and will ensure that repayments are only included in the tax computation if the income is above the statutory repayment threshold for the tax year. Student Loan Repayment Plans With Forgiveness Finally student loan forgiveness programs that are part of repayment programs such as IBR or PAYE where you get your balance forgiven after making 20 or 25 years of payments is considered taxable income. The amount of student loan you repay changes every tax year so keep an eye on changes to the thresholds on the HMRC website. If you default or otherwise dont pay your student loans up to 100 of your federal income tax refund may be taken to satisfy your debt. Your loan repayment will be frozen until at least September 2021 any wages or taxes garnished since March 2020 will likely be returned at some point your.

The amount of student loan you repay changes every tax year so keep an eye on changes to the thresholds on the HMRC website. 8 satır When filling in your tax return you will need to include the total of any student loan. Many Americans receive a tax refund each year. The tax difference between MFJ and MFS with no children is attributable to the deduction for student loan interest on the MFJ return which is not allowed when MFS and the difference in. Taxfiler will calculate the repayments due and will ensure that repayments are only included in the tax computation if the income is above the statutory repayment threshold for the tax year.

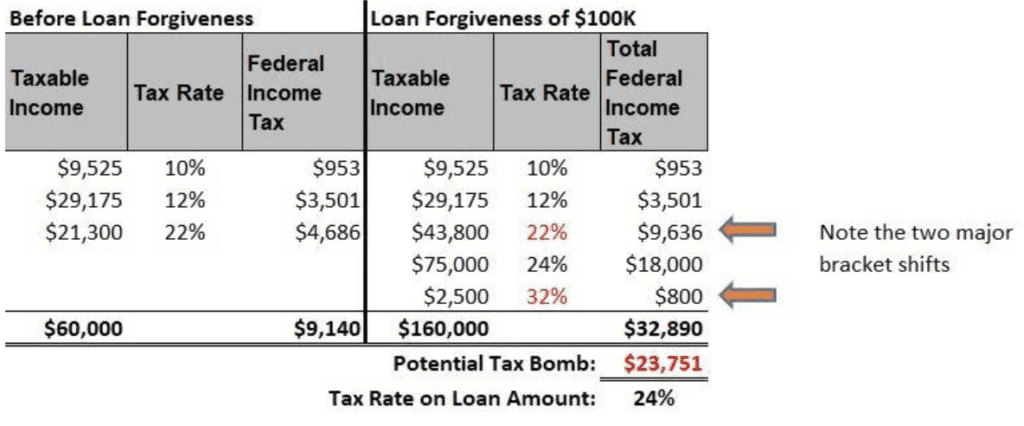

Student Loan Repayment Plans With Forgiveness Finally student loan forgiveness programs that are part of repayment programs such as IBR or PAYE where you get your balance forgiven after making 20 or 25 years of payments is considered taxable income. However through December 31 2025 these programs also are tax-free on the Federal level. Getting a financial windfall such as a tax refund can be a great way to accelerate student loan repayment. The spouse with the student loans debtor is in the Income Contingent Repayment program ICR. Your student loan interest reported on line 31900 with other non-refundable credits reported on lines 30000 to 33500 of your income tax and benefits return gives you a total of 15 reduction on your taxes.

For any SL types the percentage is 9 for PGL it is 6. However through December 31 2025 these programs also are tax-free on the Federal level. For any SL types the percentage is 9 for PGL it is 6. The calculated repayment amount will be a percentage of all net adjusted income above a threshold. The student loan repayment due for the year is calculated from your income in the tax year NOT the amount of debt remaining.

If your income is under the Plan 2 threshold 524 a week or 2274 a month your repayments. The Revenue Procedure provides relief when the federal loans are discharged by the Department of Education under the Closed School or Defense to Repayment discharge process or where the private loans are discharged based on settlements of certain types of legal causes of action against nonprofit or other for-profit schools and certain private lenders. If you default or otherwise dont pay your student loans up to 100 of your federal income tax refund may be taken to satisfy your debt. The amount of student loan you repay changes every tax year so keep an eye on changes to the thresholds on the HMRC website. The results show that as a broad generalization as total income increases the net benefit of the income-driven plans decreases and eventually the tax cost of MFS exceeds the loan repayment savings.

If you default or otherwise dont pay your student loans up to 100 of your federal income tax refund may be taken to satisfy your debt. Your loan repayment will be frozen until at least September 2021 any wages or taxes garnished since March 2020 will likely be returned at some point your. However through December 31 2025 these programs also are tax-free on the Federal level. Youll need to complete the student and or postgraduate loan PGL repayment section of your Self Assessment tax return if the Student Loans Company SLC. 8 satır When filling in your tax return you will need to include the total of any student loan.

Your loan repayment will be frozen until at least September 2021 any wages or taxes garnished since March 2020 will likely be returned at some point your. The tax difference between MFJ and MFS with no children is attributable to the deduction for student loan interest on the MFJ return which is not allowed when MFS and the difference in. You pay back 9 of your income over the Plan 1 threshold 382 a week or 1657 a month. 6 of the amount you earn over the threshold for the Postgraduate Loan. One spouse makes 50000 per year and the other spouse makes 25000 per year and owes 60000 in federal student loans.

The spouse with the student loans debtor is in the Income Contingent Repayment program ICR. Many Americans receive a tax refund each year. The non-refundable tax credits are designed to reduce your federal tax liability to zero taxes. If the sum of all your relevant income exceeds the annual threshold 18330 plan 1 25000 plan 2 Student Loan repayments of 9 will be deducted on anything over the threshold and will be included in your Self Assessment tax bill After each payment the Students Loans Company will send you a yearly Statement with your outstanding balance. Student Loan Repayment Plans With Forgiveness Finally student loan forgiveness programs that are part of repayment programs such as IBR or PAYE where you get your balance forgiven after making 20 or 25 years of payments is considered taxable income.

The results show that as a broad generalization as total income increases the net benefit of the income-driven plans decreases and eventually the tax cost of MFS exceeds the loan repayment savings. Postgraduate loan repayments England and Wales only are due at a rate of 6 on earnings above 21000. Student Loan Repayment Thresholds. Your loan repayment will be frozen until at least September 2021 any wages or taxes garnished since March 2020 will likely be returned at some point your. For any SL types the percentage is 9 for PGL it is 6.

Many Americans receive a tax refund each year. Youll need to complete the student and or postgraduate loan PGL repayment section of your Self Assessment tax return if the Student Loans Company SLC. The student loan repayment due for the year is calculated from your income in the tax year NOT the amount of debt remaining. If the sum of all your relevant income exceeds the annual threshold 18330 plan 1 25000 plan 2 Student Loan repayments of 9 will be deducted on anything over the threshold and will be included in your Self Assessment tax bill After each payment the Students Loans Company will send you a yearly Statement with your outstanding balance. Postgraduate loan repayments England and Wales only are due at a rate of 6 on earnings above 21000.

The IRS processed nearly 1116 million returns claiming refunds in 2019 with the average refund coming in at 2860. Understanding Non-Refundable Tax Credits. If that spouse files a tax return as married filing separately the monthly ICR payment could be as low as 25 per month. The student loan repayment due for the year is calculated from your income in the tax year NOT the amount of debt remaining. Getting a financial windfall such as a tax refund can be a great way to accelerate student loan repayment.

If your income is under the Plan 2 threshold 524 a week or 2274 a month your repayments. One spouse makes 50000 per year and the other spouse makes 25000 per year and owes 60000 in federal student loans. Whether you are employed or self employed the repayment thresholds are the same. If you default or otherwise dont pay your student loans up to 100 of your federal income tax refund may be taken to satisfy your debt. However through December 31 2025 these programs also are tax-free on the Federal level.

Student Loan Repayment Thresholds. Plan 2 loan repayments are due at a rate of 9 on earnings above 25725. The non-refundable tax credits are designed to reduce your federal tax liability to zero taxes. For any SL types the percentage is 9 for PGL it is 6. If your income is under the Plan 2 threshold 524 a week or 2274 a month your repayments.

According to the IRSs latest tax rules any student loan forgiveness benefits that you receive will need to be declared on your IRS tax return and will be counted against your taxable income for the year meaning that they will add to your eventual tax bill. The amount of student loan you repay changes every tax year so keep an eye on changes to the thresholds on the HMRC website. The calculated repayment amount will be a percentage of all net adjusted income above a threshold. Getting a financial windfall such as a tax refund can be a great way to accelerate student loan repayment. For any SL types the percentage is 9 for PGL it is 6.

If your income is under the Plan 2 threshold 524 a week or 2274 a month your repayments. The student loan repayment due for the year is calculated from your income in the tax year NOT the amount of debt remaining. Youll need to complete the student and or postgraduate loan PGL repayment section of your Self Assessment tax return if the Student Loans Company SLC. The tax difference between MFJ and MFS with no children is attributable to the deduction for student loan interest on the MFJ return which is not allowed when MFS and the difference in. This section is accessed via the data input tab within the tax return and is used to indicate that the tax payer is eligible to make Student Loan repayments.

Many Americans receive a tax refund each year. Your loan repayment will be frozen until at least September 2021 any wages or taxes garnished since March 2020 will likely be returned at some point your. The IRS processed nearly 1116 million returns claiming refunds in 2019 with the average refund coming in at 2860. Whether you are employed or self employed the repayment thresholds are the same. For any SL types the percentage is 9 for PGL it is 6.

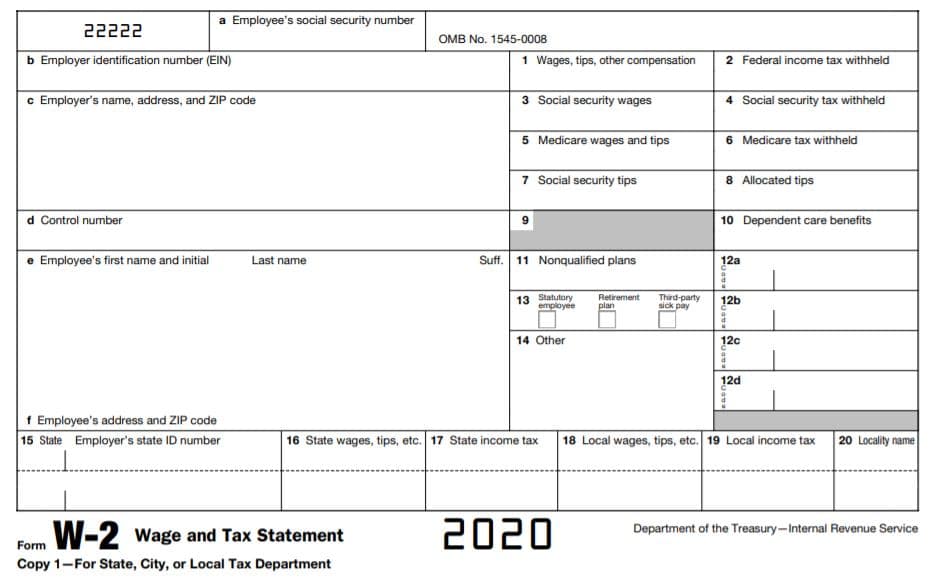

8 satır When filling in your tax return you will need to include the total of any student loan. Whether you are employed or self employed the repayment thresholds are the same. If the sum of all your relevant income exceeds the annual threshold 18330 plan 1 25000 plan 2 Student Loan repayments of 9 will be deducted on anything over the threshold and will be included in your Self Assessment tax bill After each payment the Students Loans Company will send you a yearly Statement with your outstanding balance. The IRS processed nearly 1116 million returns claiming refunds in 2019 with the average refund coming in at 2860. The student loan repayment due for the year is calculated from your income in the tax year NOT the amount of debt remaining.

If that spouse files a tax return as married filing separately the monthly ICR payment could be as low as 25 per month. The calculated repayment amount will be a percentage of all net adjusted income above a threshold. Your loan repayment will be frozen until at least September 2021 any wages or taxes garnished since March 2020 will likely be returned at some point your. Whether you are employed or self employed the repayment thresholds are the same. You pay back 9 of your income over the Plan 1 threshold 382 a week or 1657 a month.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title student loan repayment tax return by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.