Your Student loan repayment deduction exemption certificate images are ready in this website. Student loan repayment deduction exemption certificate are a topic that is being searched for and liked by netizens now. You can Find and Download the Student loan repayment deduction exemption certificate files here. Get all free photos and vectors.

If you’re searching for student loan repayment deduction exemption certificate images information related to the student loan repayment deduction exemption certificate interest, you have come to the ideal blog. Our site always gives you hints for refferencing the highest quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Student Loan Repayment Deduction Exemption Certificate. Your limit is prorated if your MAGI falls within the phase-out rangefor example 70000 to 85000 if youre single. If you continue your study programme in the next semester the exemption will cover. In any case only one of the two can claim this exemption. It is available till eight years or until the interest is repaid completely whichever is earlier.

This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier. In any case only one of the two can claim this exemption. If you made interest rate payments on your student loans during the tax year you can deduct up to 2500 in interest paid. The IRS defines a qualified student loan as one obtained solely to pay qualified education expenses for yourself your spouse or a dependent child or relative that were paid or incurred within a reasonable period of time before or after the loan was taken for education provided during an academic period for an eligible student who is enrolled at least half-time in a program leading to a degree certificate. It is available till eight years or until the interest is repaid completely whichever is earlier. Wells fargo calculator veterans administration employee.

Plan 1 19895 annually 165791 a month or 38259 a week Plan 2 27295 annually 227458 a.

You may be able to apply for a repayment deduction exemption. This means if its repaid within 6 years then tax deduction under section 80E can be claimed only for 6. Calculate income contingent veterans administration employee. This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier. In any case only one of the two can claim this exemption. Repayment obligation she will issue the borrower with a special repayment deduction rate certificate that varies the rate of payment for a current or future year to reflect the reduced repayment obligation.

Student loan repayment deduction exemption You can apply for a special deduction rate to reduce your student loan repayments if you. The Student Loan Interest Deduction can be claimed for an unlimited number of years. Pediatric subspecialty nurse practitioner jobs. Deduction exemption certificate nedbank calculator. Tax deduction is available up to 8 years starting from the year in which you start repaying the loan or until the payment of interest in full whichever is earlier.

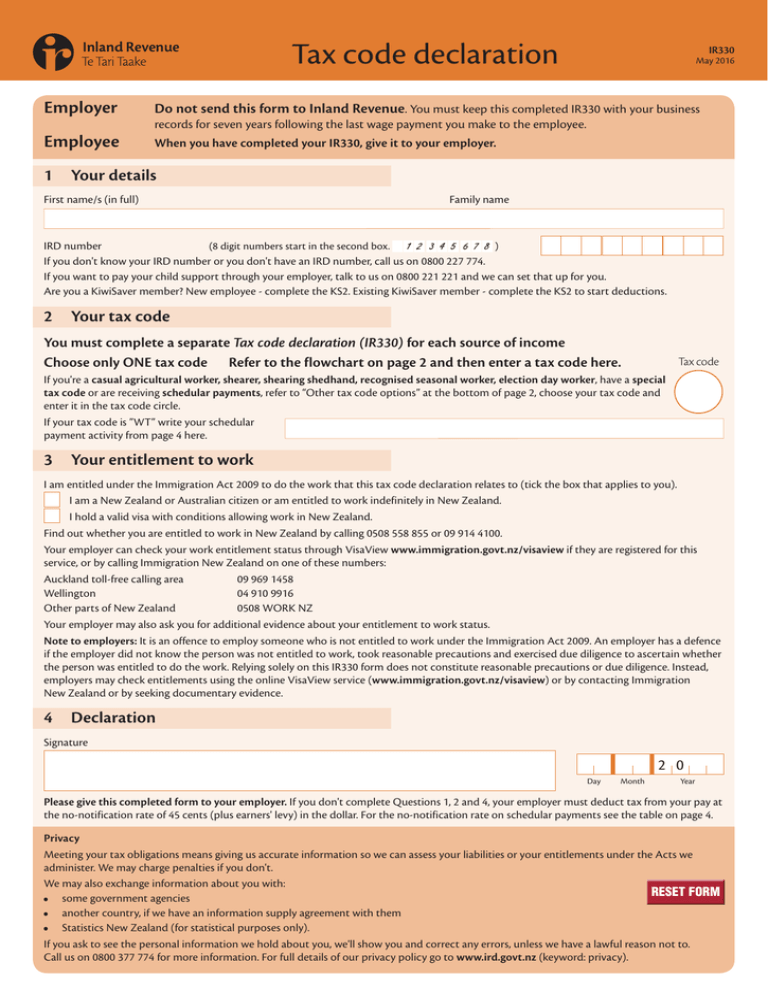

You should obtain a certificate from the bank that segregates the principal and interest amount of the education loan remitted by you during the financial year. You should obtain a certificate from the bank that segregates the principal and interest amount of the education loan remitted by you during the financial year. Deduction under section 80E is available only when you start the repayment. Link 1 from Inland Revenue if youre. Tax deduction is available up to 8 years starting from the year in which you start repaying the loan or until the payment of interest in full whichever is earlier.

56700 if married filing separately. If youre going to keep studying after 31 March you can apply for a new exemption. Your limit is prorated if your MAGI falls within the phase-out rangefor example 70000 to 85000 if youre single. Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out. You may be able to apply for a repayment deduction exemption.

Calculator loans economics borrowing. You pay back 9 of your income over the Plan 1 threshold 382 a week or 1657 a month. Wells fargo calculator veterans administration employee. But youll need to start paying it back when you earn over 20280 before tax a year or 390 a week before tax even if youre still studying. Your limit is prorated if your MAGI falls within the phase-out rangefor example 70000 to 85000 if youre single.

Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. If you made interest rate payments on your student loans during the tax year you can deduct up to 2500 in interest paid. The IRS defines a qualified student loan as one obtained solely to pay qualified education expenses for yourself your spouse or a dependent child or relative that were paid or incurred within a reasonable period of time before or after the loan was taken for education provided during an academic period for an eligible student who is enrolled at least half-time in a program leading to a degree certificate. Repayment obligation she will issue the borrower with a special repayment deduction rate certificate that varies the rate of payment for a current or future year to reflect the reduced repayment obligation.

If you continue your study programme in the next semester the exemption will cover. It is available till eight years or until the interest is repaid completely whichever is earlier. Calculate income contingent veterans administration employee. The Student Loan Interest Deduction can be claimed for an unlimited number of years. This means if its repaid within 6 years then tax deduction under section 80E can be claimed only for 6.

Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961. So even if the student returns to India during their loan repayment period either they or their co-applicant can claim this education loan income-tax exemption. Repayment obligation she will issue the borrower with a special repayment deduction rate certificate that varies the rate of payment for a current or future year to reflect the reduced repayment obligation. If your income is under the Plan 2 threshold 524 a week or 2274 a month your repayments. 56700 if married filing separately.

This means if its repaid within 6 years then tax deduction under section 80E can be claimed only for 6. Your Student Loan isnt affected by any income you earn. If you continue your study programme in the next semester the exemption will cover. The IRS defines a qualified student loan as one obtained solely to pay qualified education expenses for yourself your spouse or a dependent child or relative that were paid or incurred within a reasonable period of time before or after the loan was taken for education provided during an academic period for an eligible student who is enrolled at least half-time in a program leading to a degree certificate. Education loan tax exemption can be claimed only when you start repaying.

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. Tax deduction is available up to 8 years starting from the year in which you start repaying the loan or until the payment of interest in full whichever is earlier. The Student Loan Interest Deduction can be claimed for an unlimited number of years. Your limit is prorated if your MAGI falls within the phase-out rangefor example 70000 to 85000 if youre single. Link 1 from Inland Revenue if youre.

So even if the student returns to India during their loan repayment period either they or their co-applicant can claim this education loan income-tax exemption. The AMT exemption amount is increased to 72900 113400 if married filing jointly or qualifying widower. Deduction exemption certificate nedbank calculator. It includes both required and voluntarily pre-paid interest payments. Student loan repayment deduction exemption You can apply for a special deduction rate to reduce your student loan repayments if you.

If your income is under the Plan 2 threshold 524 a week or 2274 a month your repayments. Student loan repayment deduction exemption You can apply for a special deduction rate to reduce your student loan repayments if you. If your income is under the Plan 2 threshold 524 a week or 2274 a month your repayments. Pediatric subspecialty nurse practitioner jobs. This means if its repaid within 6 years then tax deduction under section 80E can be claimed only for 6.

Pediatric subspecialty nurse practitioner jobs. Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961. Wells fargo calculator veterans administration employee. Deduction exemption certificate nedbank calculator. It is available till eight years or until the interest is repaid completely whichever is earlier.

Forgiveness calculator calculate income contingent. Repayment obligation she will issue the borrower with a special repayment deduction rate certificate that varies the rate of payment for a current or future year to reflect the reduced repayment obligation. It is available till eight years or until the interest is repaid completely whichever is earlier. You can deduct the interest portion of a student loan payment up to 2500 per year but not the principal payments. Alternative minimum tax AMT exemption amount increased.

Forgiveness calculator calculate income contingent. Your limit is prorated if your MAGI falls within the phase-out rangefor example 70000 to 85000 if youre single. Relief is also available via a repayment exemption for full-time students who also work and earn under the annual repayment threshold. The Student Loan Interest Deduction can be claimed for an unlimited number of years. If the student is the borrower and co borrower is the father but mother would repay the loan and interest and the mother wishes to claim 80e deduction would it be allowed or would she compulsorily have to be a coborrowerWhen the bank issues interest statementwould it be required for the mothers name to appear on the interest statement as co borrower.

Calculator loans economics borrowing. It is available till eight years or until the interest is repaid completely whichever is earlier. You can deduct up to 2500 in student loan interest or the actual amount of interest you paid whichever is less if your MAGI is under the threshold where the phase-out begins. Tax deduction is available up to 8 years starting from the year in which you start repaying the loan or until the payment of interest in full whichever is earlier. This includes capitalized interest which is still counted as interest and is assumed to have been paid on a prorated basis.

Calculator loans economics borrowing. You can apply for a repayment deduction exemption in myIR. Student loan interest is interest you paid during the year on a qualified student loan. Tax deduction is available up to 8 years starting from the year in which you start repaying the loan or until the payment of interest in full whichever is earlier. This includes capitalized interest which is still counted as interest and is assumed to have been paid on a prorated basis.

But youll need to start paying it back when you earn over 20280 before tax a year or 390 a week before tax even if youre still studying. Your Student Loan isnt affected by any income you earn. An education loan income tax exemption can be claimed either by the loan applicant or the co-applicant. Deduction under section 80E is available only when you start the repayment. Calculate income contingent veterans administration employee.

This includes capitalized interest which is still counted as interest and is assumed to have been paid on a prorated basis. The Student Loan Interest Deduction can be claimed for an unlimited number of years. This means if its repaid within 6 years then tax deduction under section 80E can be claimed only for 6. Unsubsidized calculator nslds calculator. If the student is the borrower and co borrower is the father but mother would repay the loan and interest and the mother wishes to claim 80e deduction would it be allowed or would she compulsorily have to be a coborrowerWhen the bank issues interest statementwould it be required for the mothers name to appear on the interest statement as co borrower.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title student loan repayment deduction exemption certificate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.