Your Student loan interest deduction refinance images are ready. Student loan interest deduction refinance are a topic that is being searched for and liked by netizens now. You can Download the Student loan interest deduction refinance files here. Get all free photos and vectors.

If you’re searching for student loan interest deduction refinance pictures information linked to the student loan interest deduction refinance keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

Student Loan Interest Deduction Refinance. If you made interest rate payments on your student loans during the tax year you can deduct up to 2500 in interest paid. However this isnt true you can deduct interest payments made toward any type of student loans both federal and private. If you refinance your student loan for more than the original loan amount the additional amount must be used to pay for education expenses such as. If youre repaying student loans you may be able to deduct up to 2500 in interest payments from your taxable income on your 2020 tax return.

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

How Does Refinancing Student Loans Affect Taxes Student Loan Planner

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. For information about applying this deduction to. Not all loans will qualify. Average student loan interest deduction worth 188 Like other tax deductions the student loan interest deduction helps you by reducing how much of your income is taxed. Fortunately for borrowers in most cases refinancing will not impact the student loan interest deduction. In this case your taxable income is lowered by the amount of student loan interest you paid in 2019 up to 2500.

Yes even if you refinance the interest payments made on your new student loan will still be tax deductibleEither 2500 or the student loan interest you paid that year whichever is smaller is the maximum amount eligible for deduction.

Please enter the information from Form 1098-E exactly as it appears. If you refinance your student loan for more than the original loan amount the additional amount must be used to pay for education expenses such as. In this case your taxable income is lowered by the amount of student loan interest you paid in 2019 up to 2500. Student loan interest is interest you paid during the year on a qualified student loan. Fortunately for borrowers in most cases refinancing will not impact the student loan interest deduction. Many borrowers fear that a student loan refinance could mean the end of the student loan interest tax deduction.

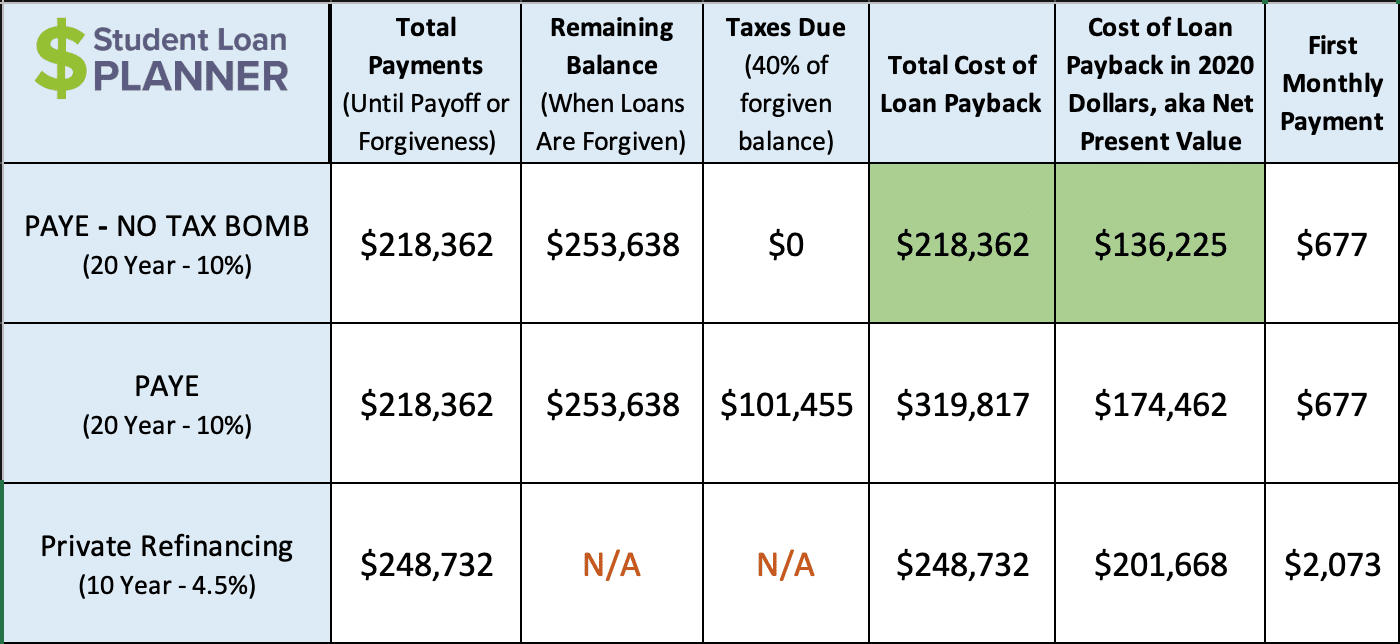

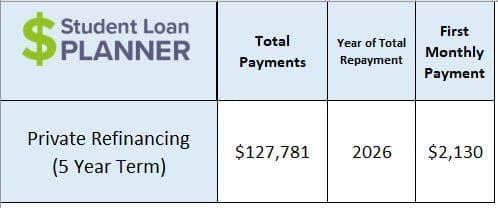

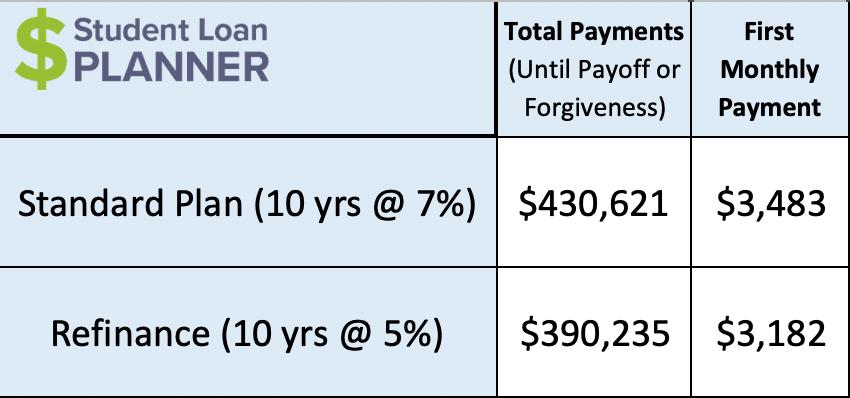

If youre on the hunt for an education loan undergrad graduate or parent loanSoFi offers private loans with flexible repayment options competitive rates and no fees. When a student loan is refinanced or multiple loans are consolidated all of the capitalized interest is considered paid by the proceeds from the new loan. Thats why the Federal government introduced the student loan interest tax deduction to help ordinary students out. The student loan interest deduction is a nice tax benefit but paying less interest overall can save you much more money than just getting a small portion of your interest back each year. Depending on the amount of student loan debt you have you can lower your interest rate and still take advantage of the student loan deduction for 2021 and years beyond.

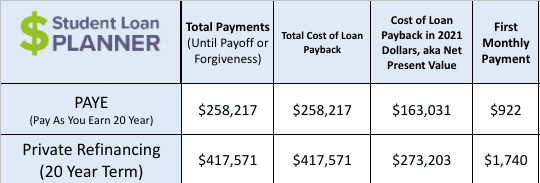

Should I refinance my federal student loan into a private student loan with a lower rate. For information about applying this deduction to. If you made federal student loan payments in 2019 you may be eligible to deduct a portion of the interest paid on your 2019 federal tax return. Student loan interest is interest you paid during the year on a qualified student loan. The student loan interest deduction 2019 cap is set at 2500 so this is the maximum amount you can get deducted.

Please keep in mind however that your student loan interest deduction for the year is capped at 2500. If you made federal student loan payments in 2019 you may be eligible to deduct a portion of the interest paid on your 2019 federal tax return. Dont miss out on this opportunity to make the money youve paid work for you. If youre eligible you can take this deduction on interest paid on federal or private student loans. However that bill stalled in the House Committee on Ways and Means.

If you made interest rate payments on your student loans during the tax year you can deduct up to 2500 in interest paid. Yes even if you refinance the interest payments made on your new student loan will still be tax deductibleEither 2500 or the student loan interest you paid that year whichever is smaller is the maximum amount eligible for deduction. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. How Much Can You Save With the Student Loan Interest Deduction. If youre on the hunt for an education loan undergrad graduate or parent loanSoFi offers private loans with flexible repayment options competitive rates and no fees.

Refinancing usually means a new lender new interest rate and new monthly payment. The IRS may allow you to deduct up to 2500 in interest youve paid on your student loans during the course of a year. However a small group of borrowers will receive a slightly smaller deduction or lose the student loan interest deduction. Most private and federal student loans are fair game. Refinancing usually means a new lender new interest rate and new monthly payment.

Many borrowers fear that a student loan refinance could mean the end of the student loan interest tax deduction. The student loan interest deduction 2019 cap is set at 2500 so this is the maximum amount you can get deducted. Most private and federal student loans are fair game. The maximum benefit from the student loan interest deduction is 550 this year but the average amount even in a typical year is smaller. Student loan interest is interest you paid during the year on a qualified student loan.

The student loan interest deduction is a nice tax benefit but paying less interest overall can save you much more money than just getting a small portion of your interest back each year. However this isnt true you can deduct interest payments made toward any type of student loans both federal and private. However a small group of borrowers will receive a slightly smaller deduction or lose the student loan interest deduction. It can lower your tax bill by as much as 625. Your new refinanced loan may not be considered a student loan for the purposes of the student loan interest tax deduction.

If youre eligible you can take this deduction on interest paid on federal or private student loans. The Student Loan Interest Deduction Act of 2019 aimed to increase the deduction to 5000 or 10000 for married taxpayers filing joint returns when it was introduced to Congress in June 2019. The maximum benefit from the student loan interest deduction is 550 this year but the average amount even in a typical year is smaller. Many borrowers fear that a student loan refinance could mean the end of the student loan interest tax deduction. If youre eligible you can take this deduction on interest paid on federal or private student loans.

Please enter the information from Form 1098-E exactly as it appears. If you made interest rate payments on your student loans during the tax year you can deduct up to 2500 in interest paid. Should I refinance my federal student loan into a private student loan with a lower rate. This is known as a student loan interest deduction. It includes both required and voluntarily pre-paid interest payments.

By refinancing your student loans and having a plan to pay them off as quickly as possible you can reduce how much interest you pay each month and over the life of your loan. You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. Dont miss out on this opportunity to make the money youve paid work for you. Yes even if you refinance the interest payments made on your new student loan will still be tax deductibleEither 2500 or the student loan interest you paid that year whichever is smaller is the maximum amount eligible for deduction. This is known as a student loan interest deduction.

Student loan interest can quickly add up. If youre on the hunt for an education loan undergrad graduate or parent loanSoFi offers private loans with flexible repayment options competitive rates and no fees. However a small group of borrowers will receive a slightly smaller deduction or lose the student loan interest deduction. Fortunately for borrowers in most cases refinancing will not impact the student loan interest deduction. If youre eligible you can take this deduction on interest paid on federal or private student loans.

Please keep in mind however that your student loan interest deduction for the year is capped at 2500. Loans must have been used for qualifying educational expenses according to the IRS. Average student loan interest deduction worth 188 Like other tax deductions the student loan interest deduction helps you by reducing how much of your income is taxed. Your new refinanced loan may not be considered a student loan for the purposes of the student loan interest tax deduction. However this isnt true you can deduct interest payments made toward any type of student loans both federal and private.

Most private and federal student loans are fair game. The student loan interest deduction is a nice tax benefit but paying less interest overall can save you much more money than just getting a small portion of your interest back each year. If you made interest rate payments on your student loans during the tax year you can deduct up to 2500 in interest paid. The maximum student loan interest deduction limit is 2500 as of the current 2018 tax year even if you paid more to your student loans in a given year. However this isnt true you can deduct interest payments made toward any type of student loans both federal and private.

You may deduct the lesser of 2500 or the amount of interest you actually paid during the year. It can lower your tax bill by as much as 625. Many borrowers fear that a student loan refinance could mean the end of the student loan interest tax deduction. The student loan interest deduction is designed to help make college more affordable for students and their parents. There is a common misconception that once you refinance student loans with a private lender you can no longer claim student loan interest payments on your taxes.

Please enter the information from Form 1098-E exactly as it appears. If you have private loans you may want to consider refinancing those loans now to score a lower interest rate and save money over the life of the loans. The student loan interest deduction 2019 cap is set at 2500 so this is the maximum amount you can get deducted. If you made federal student loan payments in 2019 you may be eligible to deduct a portion of the interest paid on your 2019 federal tax return. However a small group of borrowers will receive a slightly smaller deduction or lose the student loan interest deduction.

Student loan interest is interest you paid during the year on a qualified student loan. Please enter the information from Form 1098-E exactly as it appears. Yes even if you refinance the interest payments made on your new student loan will still be tax deductibleEither 2500 or the student loan interest you paid that year whichever is smaller is the maximum amount eligible for deduction. If youre repaying student loans you may be able to deduct up to 2500 in interest payments from your taxable income on your 2020 tax return. For information about applying this deduction to.

It can lower your tax bill by as much as 625. The student loan interest deduction is a nice tax benefit but paying less interest overall can save you much more money than just getting a small portion of your interest back each year. There is a common misconception that once you refinance student loans with a private lender you can no longer claim student loan interest payments on your taxes. The student loan interest deduction is designed to help make college more affordable for students and their parents. In this case your taxable income is lowered by the amount of student loan interest you paid in 2019 up to 2500.

If youre repaying student loans you may be able to deduct up to 2500 in interest payments from your taxable income on your 2020 tax return. The student loan interest deduction is designed to help make college more affordable for students and their parents. Many borrowers fear that a student loan refinance could mean the end of the student loan interest tax deduction. If you made interest rate payments on your student loans during the tax year you can deduct up to 2500 in interest paid. There is a common misconception that once you refinance student loans with a private lender you can no longer claim student loan interest payments on your taxes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title student loan interest deduction refinance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.