Your Scholarly articles on student loan debt images are available. Scholarly articles on student loan debt are a topic that is being searched for and liked by netizens today. You can Find and Download the Scholarly articles on student loan debt files here. Get all royalty-free images.

If you’re looking for scholarly articles on student loan debt pictures information connected with to the scholarly articles on student loan debt topic, you have pay a visit to the right site. Our website always provides you with hints for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

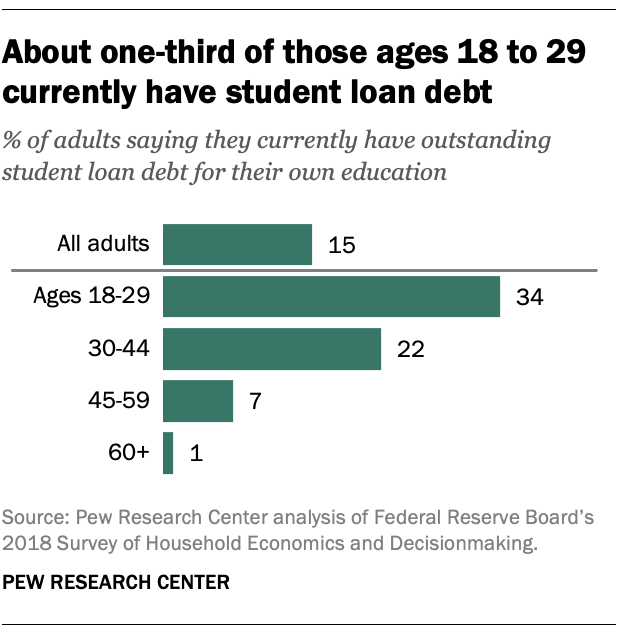

Scholarly Articles On Student Loan Debt. This is compared to 3 of those without student loans. Previous research has shown that the presence of student debt jeopardized the shortterm financial wealth of US. This rise accompanied with high delinquency rate of over 11 percent has created a student debt crisis that can potentially adversely affect millions of borrowers. Robb Moody Abdel-Ghany 2012.

Bullet Journal Student Loan Tracker Chart Bullet Journal Student Student Loans Bullet Journal

Bullet Journal Student Loan Tracker Chart Bullet Journal Student Student Loans Bullet Journal

The amount Americans owe on their student loans. Previous research has shown that the presence of student debt jeopardized the shortterm financial wealth of US. Forty million people in the United States hold student debt totaling 1 trillion. The numbers are staggering. Research on student loan debt shows that as loans climb higher they weigh on borrowers most intimate and personal life decisions. More than 12 trillion in outstanding student loan debt 40 million borrowers an average balance of 29000.

As of 2020 student loan debt has surpassed 15 trillion.

While other forms of consumer credit declined during the Great Recession see Figure 1 student debt. Households during the Great Recession. Lump-sum format which reduces perceived payoff difficulty. A 1000 increase in student loan debt lowers the homeownership rate by about 15 percentage points for public four-year college-goers during. People with higher student loans. Now the spotlight is on student debt.

Joo Durband. Student Loan Debt on the Rise Federal Reserve Bank of Cleveland January 31 2014. Total 864 billion and private student loans total 150 billion equaling more than 1 trillion in current student debt28 Though the Federal Family Education Loan. People with higher student loans. 3 Ann Marie Wiersch The Cost of College.

Economists project an accumulated student loan debt of 2 trillion by 2021 and at a growth rate of 7 a year as much as 3 trillion or more by the end of the next decade. Even students in Sweden where tuition is free leave with an average debt of about 20000. Total 864 billion and private student loans total 150 billion equaling more than 1 trillion in current student debt28 Though the Federal Family Education Loan. Households during the Great Recession. More than 12 trillion in outstanding student loan debt 40 million borrowers an average balance of 29000.

The time-honored American tradition of outlandish political promises continues apace. Robb Moody Abdel-Ghany 2012. Student loan debtat almost 14 trillion in outstanding federal loanshas ballooned into the largest source of consumer debt after housing. Government stood at 21145 trillion dollarsOf that amount 1211 trillion was borrowed so that Uncle Sam could be in the business of making student loans. The struggle to fund college is particularly tough for students from rural areas and developing nations.

Households postrecession using recent data from the 2013 and 2016 Survey of Consumer Finances. High levels of student loan debt and financial stress have been associated with increases in students likelihood of dropping out stopping out or reducing their course loads Dwyer Hodson. The amount Americans owe on their student loans. Total student loan debt has increased from 350 billion to approximately 12 trillion since 20041 During this time period outstanding student debt surpassed the amount households owe on auto loans home equity loans and credit cards. Student Loan Debt on the Rise Federal Reserve Bank of Cleveland January 31 2014.

From mid-2014 to mid-2016 39 million undergraduates with federal student loan debt dropped out according to an analysis of federal data by The. Joo Durband. Forty million people in the United States hold student debt totaling 1 trillion. We examine the effects of student loan use on the wealth of US. Approximately 9 of student loan debtors were 60 or more days delinquent in making payments on any of their debt.

This rise accompanied with high delinquency rate of over 11 percent has created a student debt crisis that can potentially adversely affect millions of borrowers. People with higher student loans. The struggle to fund college is particularly tough for students from rural areas and developing nations. Households during the Great Recession. Households postrecession using recent data from the 2013 and 2016 Survey of Consumer Finances.

An increase in student debt alone shouldnt sound. Smole A Snapshot of Student Loan Debt Congressional Research Service March 23 2015. As of 2020 student loan debt has surpassed 15 trillion. Households postrecession using recent data from the 2013 and 2016 Survey of Consumer Finances. Economists project an accumulated student loan debt of 2 trillion by 2021 and at a growth rate of 7 a year as much as 3 trillion or more by the end of the next decade.

People with higher student loans. Student Loan Debt on the Rise Federal Reserve Bank of Cleveland January 31 2014. Its not hard to find indications that student debt. Now the spotlight is on student debt. The numbers are staggering.

Lump-sum format which reduces perceived payoff difficulty. This rise accompanied with high delinquency rate of over 11 percent has created a student debt crisis that can potentially adversely affect millions of borrowers. We examine the effects of student loan use on the wealth of US. Households postrecession using recent data from the 2013 and 2016 Survey of Consumer Finances. A 1000 increase in student loan debt lowers the homeownership rate by about 15 percentage points for public four-year college-goers during.

Importantly the spending propensity associated with high student loan debt is attenuated by presenting the debt in a monthly payment vs. Student debt have more difficulty making debt payments on time. Lump-sum format which reduces perceived payoff difficulty. The numbers are staggering. An increase in student debt alone shouldnt sound.

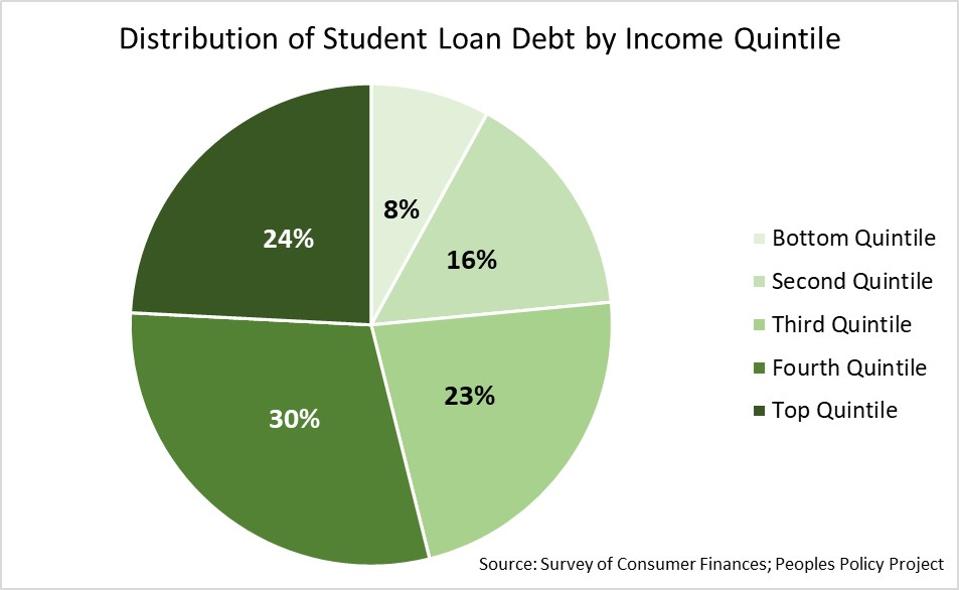

Research on student loan debt shows that as loans climb higher they weigh on borrowers most intimate and personal life decisions. Households postrecession using recent data from the 2013 and 2016 Survey of Consumer Finances. Warren touts her plan as a way to boost the economy redistribute wealth and help. Over 1 trillion of that subtotal was borrowed after President Obama took over the student loan industry on March 30 2010. Robb Moody Abdel-Ghany 2012.

Lump-sum format which reduces perceived payoff difficulty. Now the spotlight is on student debt. Student debt have more difficulty making debt payments on time. The struggle to fund college is particularly tough for students from rural areas and developing nations. Smole A Snapshot of Student Loan Debt Congressional Research Service March 23 2015.

As of 2020 student loan debt has surpassed 15 trillion. Student loan debtat almost 14 trillion in outstanding federal loanshas ballooned into the largest source of consumer debt after housing. Government stood at 21145 trillion dollarsOf that amount 1211 trillion was borrowed so that Uncle Sam could be in the business of making student loans. Total 864 billion and private student loans total 150 billion equaling more than 1 trillion in current student debt28 Though the Federal Family Education Loan. Its not hard to find indications that student debt.

Now the spotlight is on student debt. People with higher student loans. On May 31 2018 the total public debt outstanding of the US. Student Loan Debt on the Rise Federal Reserve Bank of Cleveland January 31 2014. This is compared to 3 of those without student loans.

A 1000 increase in student loan debt lowers the homeownership rate by about 15 percentage points for public four-year college-goers during. Smole A Snapshot of Student Loan Debt Congressional Research Service March 23 2015. Even students in Sweden where tuition is free leave with an average debt of about 20000. However some scholars argue that the student-debt crisis is better. Research on student loan debt shows that as loans climb higher they weigh on borrowers most intimate and personal life decisions.

Smole A Snapshot of Student Loan Debt Congressional Research Service March 23 2015. We examine the effects of student loan use on the wealth of US. Democratic presidential candidate Elizabeth Warren added to the debate recently when she put forward a proposal to cancel 640 billion worth of federal and private student loans. Smole A Snapshot of Student Loan Debt Congressional Research Service March 23 2015. Total student loan debt has increased from 350 billion to approximately 12 trillion since 20041 During this time period outstanding student debt surpassed the amount households owe on auto loans home equity loans and credit cards.

Households postrecession using recent data from the 2013 and 2016 Survey of Consumer Finances. People with higher student loans. Student debt have more difficulty making debt payments on time. Over 1 trillion of that subtotal was borrowed after President Obama took over the student loan industry on March 30 2010. Student Loan Debt on the Rise Federal Reserve Bank of Cleveland January 31 2014.

Government stood at 21145 trillion dollarsOf that amount 1211 trillion was borrowed so that Uncle Sam could be in the business of making student loans. On May 31 2018 the total public debt outstanding of the US. High levels of student loan debt and financial stress have been associated with increases in students likelihood of dropping out stopping out or reducing their course loads Dwyer Hodson. Research on student loan debt shows that as loans climb higher they weigh on borrowers most intimate and personal life decisions. This rise accompanied with high delinquency rate of over 11 percent has created a student debt crisis that can potentially adversely affect millions of borrowers.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title scholarly articles on student loan debt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.