Your Navient student loan income based repayment form images are ready in this website. Navient student loan income based repayment form are a topic that is being searched for and liked by netizens today. You can Download the Navient student loan income based repayment form files here. Get all royalty-free photos and vectors.

If you’re searching for navient student loan income based repayment form images information related to the navient student loan income based repayment form topic, you have pay a visit to the right site. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Navient Student Loan Income Based Repayment Form. A repayment plan based on your income can help you manage your federal student loan payments. When you log into your Navient account online click the link to apply for income-driven repayment and enter your information. Eligibility requirements vary by type of forbearance. You have the option of making a payment at any time during the forbearance.

Paying Student Loans Abroad

Paying Student Loans Abroad

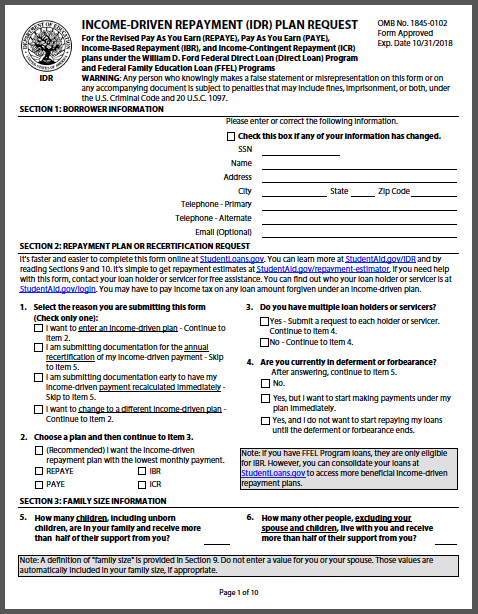

Federal Student Aid. Ask your student loan servicer for the income-driven repayment plan form. A repayment plan based on your income can help you manage your federal student loan payments. Income-Based Student Loan Repayment calculation is AGI Poverty Line x 150 Y Y x 15 12 IBR PAYMENT If you want to see what your income-based repayment could be. If you need help in filling out the form contact your loan servicer. How to Apply for Navient Student Loan Forgiveness.

Income-Based Student Loan Repayment calculation is AGI Poverty Line x 150 Y Y x 15 12 IBR PAYMENT If you want to see what your income-based repayment could be.

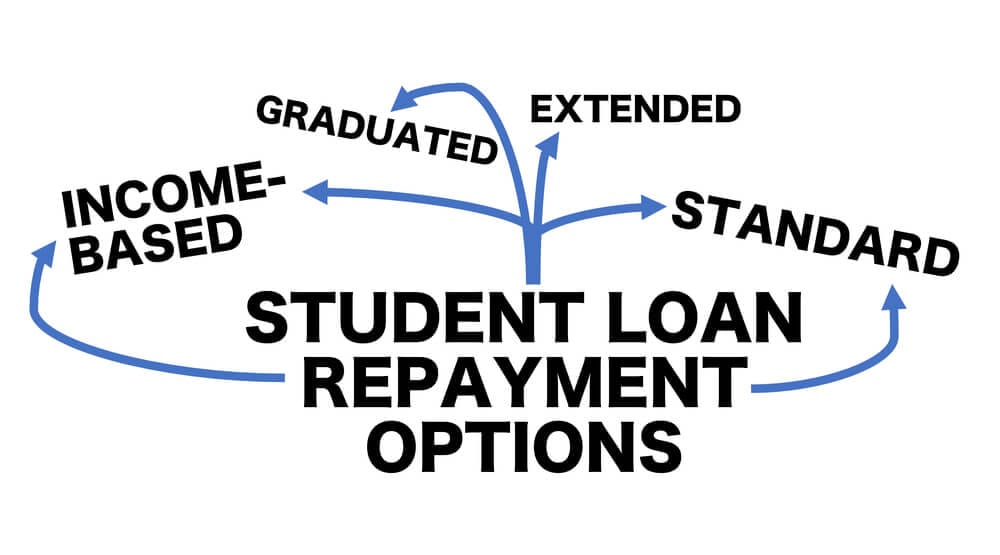

1 INCOME-DRIVEN REPAYMENT AND STUDENT LOAN AFFORDABILITY Income-driven repayment IDR plans are important tools to help students keep their federal student loan payments affordable. Federal Student Aid. Select the reason you are submitting this form. Income Based Repayment Form Navient Income Based Repayment Form. In the words of the official complaint the lawsuit accuses Navient of making subprime predatory loans to students attending for-profit colleges with graduation rates lower than 50 percent despite clear expectations that an extremely high percentage of students would not be able to repay them as part of preferred lending programs with schools in order to gain access to highly profitable federally-guaranteed loan volume and prime private student loan. Income-driven repayment IDR plans are designed to make your student loan debt more manageable by reducing your monthly payment amount.

Box 9500 Wilkes-Barre PA 18773-9500. In the words of the official complaint the lawsuit accuses Navient of making subprime predatory loans to students attending for-profit colleges with graduation rates lower than 50 percent despite clear expectations that an extremely high percentage of students would not be able to repay them as part of preferred lending programs with schools in order to gain access to highly profitable federally-guaranteed loan volume and prime private student loan. To recertify your income ahead of schedule you can electronically recalculate your IDR plan monthly payment or you can submit the paper income-based repayment form and check off the appropriate box under Section 2. When you log into your Navient account online click the link to apply for income-driven repayment and enter your information. What to do if you have a student loan serviced by Navient What to do if you have a student loan serviced by Navient.

To recertify your income ahead of schedule you can electronically recalculate your IDR plan monthly payment or you can submit the paper income-based repayment form and check off the appropriate box under Section 2. Income Based Repayment Form Navient Income Based Repayment Form. You can find out who your loan holder or servicer is at StudentAidgovlogin. What to do if you have a student loan serviced by Navient What to do if you have a student loan serviced by Navient. How to Pay off Private Student Loans from Sallie Mae Navient and.

Income-Based Repayment Plan Request Federal Family Education Loan Program Use this form for initial determination of your eligibility to repay eligible Federal Family Education Loan Program FFELP loans under the Income-Based Repayment IBR plan or for the required annual reevaluation of your payment amount under the IBR plan. If you need to make lower monthly payments or if your outstanding federal student loan debt represents a significant portion of your annual income one of the following income-driven plans may be right for you. You have the option of making a payment at any time during the forbearance. Certain eligibility conditions apply and an annual renewal is required so be sure to find out how these plans work. Examples include general forbearance mandatory forbearance student loan debt burden forbearance and teacher loan forgiveness forbearance.

Eligibility requirements vary by type of forbearance. Box 9533 Wilkes-Barre PA 18773-9533 Cosigners please be sure to send your payments to the cosigner payment address. Heres a sample but be sure to use the official application form provided by your servicer. To learn more about the different types of federal student loan forgiveness click here. What happens if you fail to recertify.

In the words of the official complaint the lawsuit accuses Navient of making subprime predatory loans to students attending for-profit colleges with graduation rates lower than 50 percent despite clear expectations that an extremely high percentage of students would not be able to repay them as part of preferred lending programs with schools in order to gain access to highly profitable federally-guaranteed loan volume and prime private student loan. You may have to pay income tax on any loan amount forgiven under an income-driven plan. To recertify your income ahead of schedule you can electronically recalculate your IDR plan monthly payment or you can submit the paper income-based repayment form and check off the appropriate box under Section 2. The amount of the discharge Box 2 Interest included Box 3. If you need to make lower monthly payments or if your outstanding federal student loan debt represents a significant portion of your annual income one of the following income-driven plans may be right for you.

To learn more about the different types of federal student loan forgiveness click here. Income Based Repayment Form Navient Income Based Repayment Form. Fill out the form attach necessary documentation and mail to the address as instructed. Ask your student loan servicer for the income-driven repayment plan form. 1 INCOME-DRIVEN REPAYMENT AND STUDENT LOAN AFFORDABILITY Income-driven repayment IDR plans are important tools to help students keep their federal student loan payments affordable.

To learn more about the different types of federal student loan forgiveness click here. If youve received at least 600 in forgiveness for your student loans youll be sent a Form 1099-C by your creditor. What happens if you fail to recertify. Eligibility requirements vary by type of forbearance. By taking advantage of Income-Based Repayment IBR Pay As You Earn PAYE or Income-Contingent Repayment ICR borrowers can benefit from meaningful reduction in their monthly payment.

You may have to pay income tax on any loan amount forgiven under an income-driven plan. 1 INCOME-DRIVEN REPAYMENT AND STUDENT LOAN AFFORDABILITY Income-driven repayment IDR plans are important tools to help students keep their federal student loan payments affordable. In the words of the official complaint the lawsuit accuses Navient of making subprime predatory loans to students attending for-profit colleges with graduation rates lower than 50 percent despite clear expectations that an extremely high percentage of students would not be able to repay them as part of preferred lending programs with schools in order to gain access to highly profitable federally-guaranteed loan volume and prime private student loan. Heres a sample but be sure to use the official application form provided by your servicer. By taking advantage of Income-Based Repayment IBR Pay As You Earn PAYE or Income-Contingent Repayment ICR borrowers can benefit from meaningful reduction in their monthly payment.

Examples include general forbearance mandatory forbearance student loan debt burden forbearance and teacher loan forgiveness forbearance. Click here for extra information about the Income-Based Student Loan Repayment Plan. Box 9555 Wilkes-Barre PA 18773-9555 General Correspondence and Submitting Documents. With this form contact your loan holder or servicer for free assistance. Heres a sample but be sure to use the official application form provided by your servicer.

In the words of the official complaint the lawsuit accuses Navient of making subprime predatory loans to students attending for-profit colleges with graduation rates lower than 50 percent despite clear expectations that an extremely high percentage of students would not be able to repay them as part of preferred lending programs with schools in order to gain access to highly profitable federally-guaranteed loan volume and prime private student loan. A repayment plan based on your income can help you manage your federal student loan payments. By taking advantage of Income-Based Repayment IBR Pay As You Earn PAYE or Income-Contingent Repayment ICR borrowers can benefit from meaningful reduction in their monthly payment. Box 9500 Wilkes-Barre PA 18773-9500. If you have a FFELP loan in an Income-Based Repayment IBR plan the payment goes first to Unpaid Interest then to Unpaid Fees and then to Unpaid Principal.

Click here for extra information about the Income-Based Student Loan Repayment Plan. Box 9500 Wilkes-Barre PA 18773-9500. You may have to pay income tax on any loan amount forgiven under an income-driven plan. If you need help in filling out the form contact your loan servicer. 1 INCOME-DRIVEN REPAYMENT AND STUDENT LOAN AFFORDABILITY Income-driven repayment IDR plans are important tools to help students keep their federal student loan payments affordable.

You can find out who your loan holder or servicer is at StudentAidgovlogin. By taking advantage of Income-Based Repayment IBR Pay As You Earn PAYE or Income-Contingent Repayment ICR borrowers can benefit from meaningful reduction in their monthly payment. Certain eligibility conditions apply and an annual renewal is required so be sure to find out how these plans work. How to Pay off Private Student Loans from Sallie Mae Navient and. When you log into your Navient account online click the link to apply for income-driven repayment and enter your information.

Heres a sample but be sure to use the official application form provided by your servicer. Certain eligibility conditions apply and an annual renewal is required so be sure to find out how these plans work. You may have to pay income tax on any loan amount forgiven under an income-driven plan. Federal Student Aid. 1 INCOME-DRIVEN REPAYMENT AND STUDENT LOAN AFFORDABILITY Income-driven repayment IDR plans are important tools to help students keep their federal student loan payments affordable.

What to do if you have a student loan serviced by Navient What to do if you have a student loan serviced by Navient. You may have to pay income tax on any loan amount forgiven under an income-driven plan. Navient makes it easy to apply for repayment plans and other forgiveness options. You can find out who your loan holder or servicer is at StudentAidgovlogin. If you need help in filling out the form contact your loan servicer.

Ensuring you file your recertification on schedule is essential to maintaining your IDR plan. Income-driven repayment IDR plans are designed to make your student loan debt more manageable by reducing your monthly payment amount. What happens if you fail to recertify. Fill out the form attach necessary documentation and mail to the address as instructed. A repayment plan based on your income can help you manage your federal student loan payments.

To learn more about the different types of federal student loan forgiveness click here. Income-Based Repayment Plan Request Federal Family Education Loan Program Use this form for initial determination of your eligibility to repay eligible Federal Family Education Loan Program FFELP loans under the Income-Based Repayment IBR plan or for the required annual reevaluation of your payment amount under the IBR plan. When you log into your Navient account online click the link to apply for income-driven repayment and enter your information. Ask your student loan servicer for the income-driven repayment plan form. Eligibility requirements vary by type of forbearance.

By taking advantage of Income-Based Repayment IBR Pay As You Earn PAYE or Income-Contingent Repayment ICR borrowers can benefit from meaningful reduction in their monthly payment. Fill out the form attach necessary documentation and mail to the address as instructed. With this form contact your loan holder or servicer for free assistance. If youve received at least 600 in forgiveness for your student loans youll be sent a Form 1099-C by your creditor. To recertify your income ahead of schedule you can electronically recalculate your IDR plan monthly payment or you can submit the paper income-based repayment form and check off the appropriate box under Section 2.

Navient makes it easy to apply for repayment plans and other forgiveness options. With this form contact your loan holder or servicer for free assistance. A repayment plan based on your income can help you manage your federal student loan payments. You can find out who your loan holder or servicer is at StudentAidgovlogin. What happens if you fail to recertify.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title navient student loan income based repayment form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.