Your Is employer student loan repayment taxable images are available in this site. Is employer student loan repayment taxable are a topic that is being searched for and liked by netizens now. You can Download the Is employer student loan repayment taxable files here. Download all free images.

If you’re looking for is employer student loan repayment taxable images information linked to the is employer student loan repayment taxable topic, you have pay a visit to the ideal blog. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

Is Employer Student Loan Repayment Taxable. The CARES Act modifies this tax treatment for payments made after March 27 2020 and on or before Dec. Tax-free employer repayments of student loans would be available for the first time under a bill introduced by Rep. Exclusion for Certain Employer Payments of Student Loans. Student loan repayment benefit means the benefit provided to an employee under this part in which an agency repays by a direct payment on behalf of the employee a qualifying student loan as described in 537106b previously taken out by such employee.

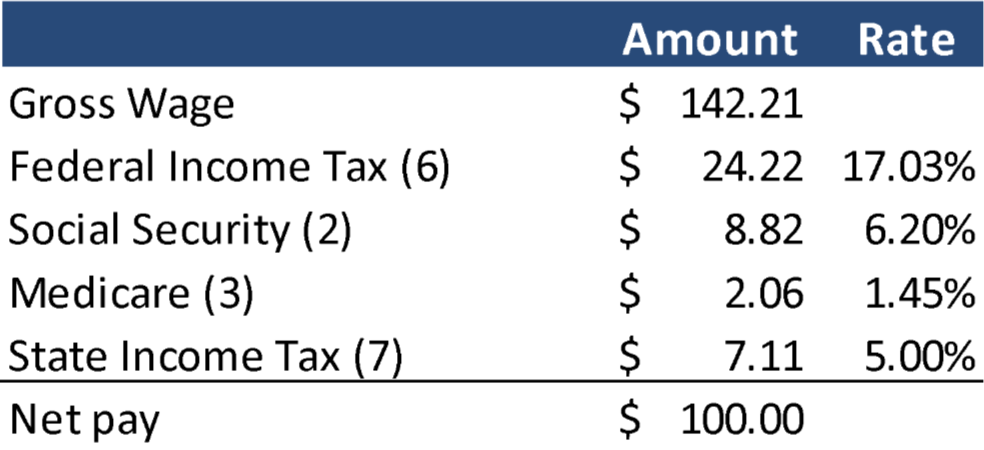

10 Payslip Templates Word Excel Pdf Formats Templates Payroll Template Payroll

10 Payslip Templates Word Excel Pdf Formats Templates Payroll Template Payroll

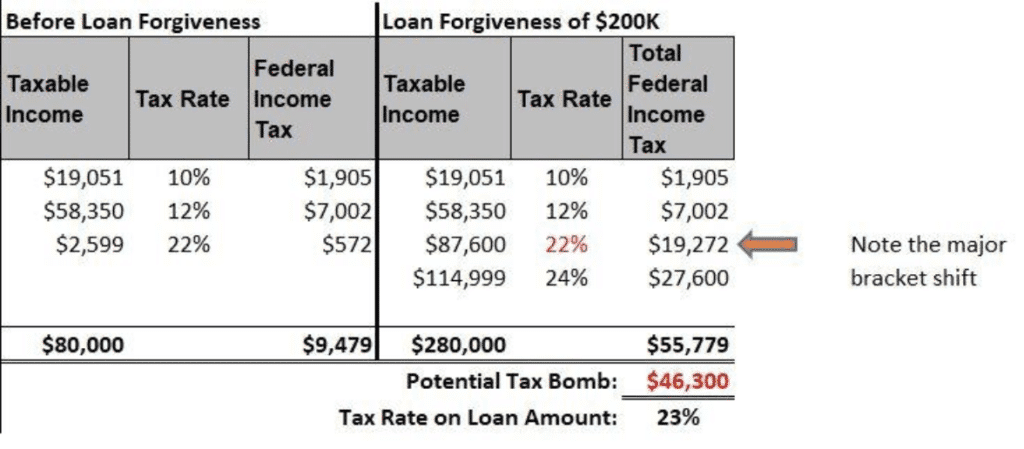

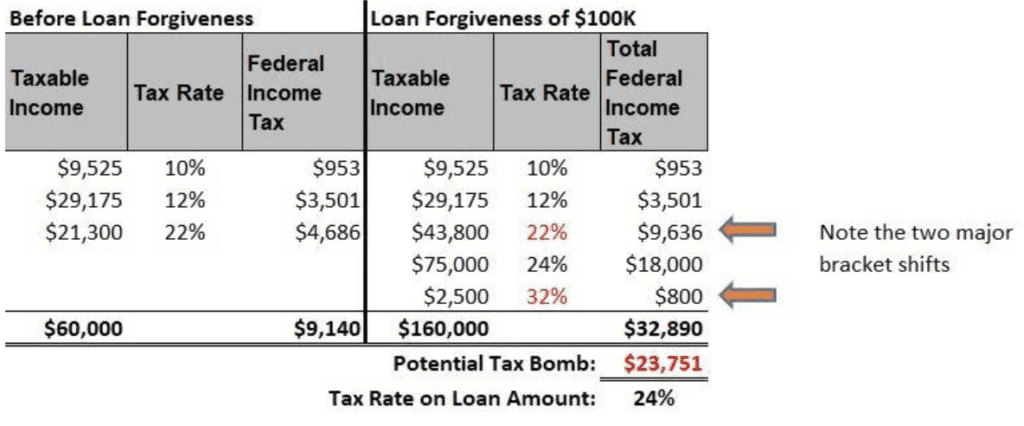

Student loan repayment benefits now unburdened due to this new legislation will undoubtedly play a key role in helping employees and employers. Student loan repayment benefit means the benefit provided to an employee under this part in which an agency repays by a direct payment on behalf of the employee a qualifying student loan as described in 537106b previously taken out by such employee. The downside of these programs is that contributions to. When employers help employees repay their student loans this money is treated as taxable income. If this did not occur then you would have what is known as cancellation of indebtedness income which is taxable. The dollar value of this benefit is the gross amount credited to the employee at the time of a loan payment to the holder of the student loan before.

If this did not occur then you would have what is known as cancellation of indebtedness income which is taxable.

Interestingly tuition reimbursement programs receive better tax. The downside of these programs is that contributions to. Ordinarily any student loan repayment assistance you receive from your employer is taxable. When employers help employees repay their student loans this money is treated as taxable income. Summary of the Bill. Is employer student loan repayment taxable.

From govtrackus Student Loan Employment Benefits Act of 2013 - Amends the Internal Revenue Code to exclude from the gross income of an employee amounts paid by an employer under a student loan payment assistance program. Student loan repayment benefits now unburdened due to this new legislation will undoubtedly play a key role in helping employees and employers. 15-B to include certain employer payments of student loans paid after March 27 2020 and before. The important thing to point is that employer student loan assistance is normally increases an employees tax bill. If this did not occur then you would have what is known as cancellation of indebtedness income which is taxable.

Interestingly tuition reimbursement programs receive better tax. From govtrackus Student Loan Employment Benefits Act of 2013 - Amends the Internal Revenue Code to exclude from the gross income of an employee amounts paid by an employer under a student loan payment assistance program. 27 2020 allows employer-provided student loan repayment as a tax-free. Exclusion for Certain Employer Payments of Student Loans. 15-B to include certain employer payments of student loans paid after March 27 2020 and before.

Student loan repayment benefit means the benefit provided to an employee under this part in which an agency repays by a direct payment on behalf of the employee a qualifying student loan as described in 537106b previously taken out by such employee. Traditionally an employers student loan contributions are subject to payroll taxes and are taxable income to the employee. Exclusion for Certain Employer Payments of Student Loans. Student loan repayment benefits now unburdened due to this new legislation will undoubtedly play a key role in helping employees and employers. From govtrackus Student Loan Employment Benefits Act of 2013 - Amends the Internal Revenue Code to exclude from the gross income of an employee amounts paid by an employer under a student loan payment assistance program.

During this time span employees can receive up to 5250 to pay their student debt and exclude it from gross income CARES Act 2206. If they finished their studies after 6 April in the current tax year they will not start to repay. With the recent extension of the rules set forth in the CARES Act employer student loan repayment contributions up to 5250 are payroll-tax and income-tax-free until January 2026. You dont have to pay taxes on up to 5250 in annual employer student loan repayment assistance. When employers help employees repay their student loans this money is treated as taxable income.

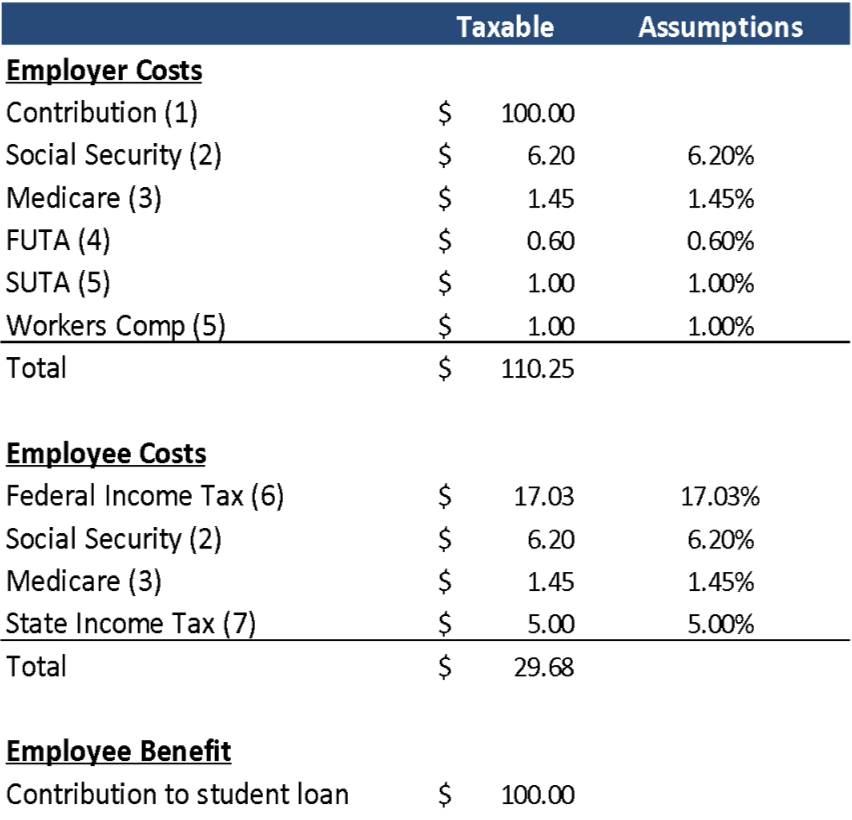

Traditionally an employers student loan contributions are subject to payroll taxes and are taxable income to the employee. The dollar value of this benefit is the gross amount credited to the employee at the time of a loan payment to the holder of the student loan before. To briefly illustrate the possible tax savings if an employer paid an employee 5250 as student loan repayment assistance outside of a qualified program the employer and the employee would both ordinarily have to pay around 400 in payroll taxes not considering the taxable wage limit. The downside of these programs is that contributions to. Basically instead of you receiving the cash you simply handed the cash back to your employer for repayment of the loan.

The CARES Act modifies this tax treatment for payments made after March 27 2020 and on or before Dec. The dollar value of this benefit is the gross amount credited to the employee at the time of a loan payment to the holder of the student loan before. Employer Student Loan Repayment - CARES Act With the new CARES Act employers can pay up to 5250 toward student loans and this amount is tax free to the employee. From govtrackus Student Loan Employment Benefits Act of 2013 - Amends the Internal Revenue Code to exclude from the gross income of an employee amounts paid by an employer under a student loan payment assistance program. Student loan repayment benefits now unburdened due to this new legislation will undoubtedly play a key role in helping employees and employers.

27 2020 allows employer-provided student loan repayment as a tax-free. The dollar value of this benefit is the gross amount credited to the employee at the time of a loan payment to the holder of the student loan before. Basically it is additional wages and elevates the employees overall taxable income. With the recent extension of the rules set forth in the CARES Act employer student loan repayment contributions up to 5250 are payroll-tax and income-tax-free until January 2026. Is employer student loan repayment taxable.

Interestingly tuition reimbursement programs receive better tax. Student loan repayment benefits now unburdened due to this new legislation will undoubtedly play a key role in helping employees and employers. Exclusion for Certain Employer Payments of Student Loans. Some employers provide tuition reimbursement or student loan repayment to attract talent. During this time span employees can receive up to 5250 to pay their student debt and exclude it from gross income CARES Act 2206.

Tax-free employer repayments of student loans would be available for the first time under a bill introduced by Rep. Traditionally an employers student loan contributions are subject to payroll taxes and are taxable income to the employee. The IRS also stated that borrowers who were unable to. You dont have to pay taxes on up to 5250 in annual employer student loan repayment assistance. The downside of these programs is that contributions to.

If this did not occur then you would have what is known as cancellation of indebtedness income which is taxable. During this time span employees can receive up to 5250 to pay their student debt and exclude it from gross income CARES Act 2206. Exclusion for Certain Employer Payments of Student Loans. 27 2020 allows employer-provided student loan repayment as a tax-free. The Consolidated Appropriations Act of 2021 signed into law by then-President Donald Trump on Dec.

Summary of the Bill. Basically it is additional wages and elevates the employees overall taxable income. When employers help employees repay their student loans this money is treated as taxable income. Student loan repayment benefit means the benefit provided to an employee under this part in which an agency repays by a direct payment on behalf of the employee a qualifying student loan as described in 537106b previously taken out by such employee. Ask your new employee if they have a student loan or a postgraduate loan - they may have both.

Traditionally an employers student loan contributions are subject to payroll taxes and are taxable income to the employee. Student loan repayment benefits now unburdened due to this new legislation will undoubtedly play a key role in helping employees and employers. With the recent extension of the rules set forth in the CARES Act employer student loan repayment contributions up to 5250 are payroll-tax and income-tax-free until January 2026. This tax break was introduced in. Employer Student Loan Repayment - CARES Act With the new CARES Act employers can pay up to 5250 toward student loans and this amount is tax free to the employee.

Ask your new employee if they have a student loan or a postgraduate loan - they may have both. From govtrackus Student Loan Employment Benefits Act of 2013 - Amends the Internal Revenue Code to exclude from the gross income of an employee amounts paid by an employer under a student loan payment assistance program. Is employer student loan repayment taxable. Basically instead of you receiving the cash you simply handed the cash back to your employer for repayment of the loan. Summary of the Bill.

Exclusion for Certain Employer Payments of Student Loans. Student loan repayment benefits now unburdened due to this new legislation will undoubtedly play a key role in helping employees and employers. To briefly illustrate the possible tax savings if an employer paid an employee 5250 as student loan repayment assistance outside of a qualified program the employer and the employee would both ordinarily have to pay around 400 in payroll taxes not considering the taxable wage limit. When employers help employees repay their student loans this money is treated as taxable income. During this time span employees can receive up to 5250 to pay their student debt and exclude it from gross income CARES Act 2206.

When employers help employees repay their student loans this money is treated as taxable income. The important thing to point is that employer student loan assistance is normally increases an employees tax bill. Basically it is additional wages and elevates the employees overall taxable income. When employers help employees repay their student loans this money is treated as taxable income. Is employer student loan repayment taxable.

Traditionally an employers student loan contributions are subject to payroll taxes and are taxable income to the employee. The important thing to point is that employer student loan assistance is normally increases an employees tax bill. There was an exception for 2020 which allowed borrowers to deduct up to 5250 from any employer-paid student loan assistance as part of pandemic relief. This tax break was introduced in. If this did not occur then you would have what is known as cancellation of indebtedness income which is taxable.

However the IRS recently clarified that federal student loans forgiven under the Borrower Defense to Repayment program is not taxable. Employer Student Loan Repayment - CARES Act With the new CARES Act employers can pay up to 5250 toward student loans and this amount is tax free to the employee. Ask your new employee if they have a student loan or a postgraduate loan - they may have both. During this time span employees can receive up to 5250 to pay their student debt and exclude it from gross income CARES Act 2206. The CARES Act modifies this tax treatment for payments made after March 27 2020 and on or before Dec.

During this time span employees can receive up to 5250 to pay their student debt and exclude it from gross income CARES Act 2206. The dollar value of this benefit is the gross amount credited to the employee at the time of a loan payment to the holder of the student loan before. Exclusion for Certain Employer Payments of Student Loans. Interestingly tuition reimbursement programs receive better tax. The Consolidated Appropriations Act of 2021 signed into law by then-President Donald Trump on Dec.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is employer student loan repayment taxable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.