Your Is cancellation of student loan debt taxable images are available in this site. Is cancellation of student loan debt taxable are a topic that is being searched for and liked by netizens now. You can Get the Is cancellation of student loan debt taxable files here. Find and Download all royalty-free photos and vectors.

If you’re looking for is cancellation of student loan debt taxable images information linked to the is cancellation of student loan debt taxable interest, you have come to the right site. Our website always gives you hints for refferencing the maximum quality video and image content, please kindly surf and locate more informative video articles and images that match your interests.

Is Cancellation Of Student Loan Debt Taxable. Ordinarily with some exceptions if a student loan is canceled forgiven or discharged for less than the amount you owe the amount of the canceled debt is treated as taxable. IRS Tax Tip 2017-23 March 2 2017. The change doesnt address future tax liabilities of loan forgiveness Currently most student debt wiped out by the federal government is considered taxable income. The standard tax treatment of debt cancellation does not work with student loans for three principal reasons.

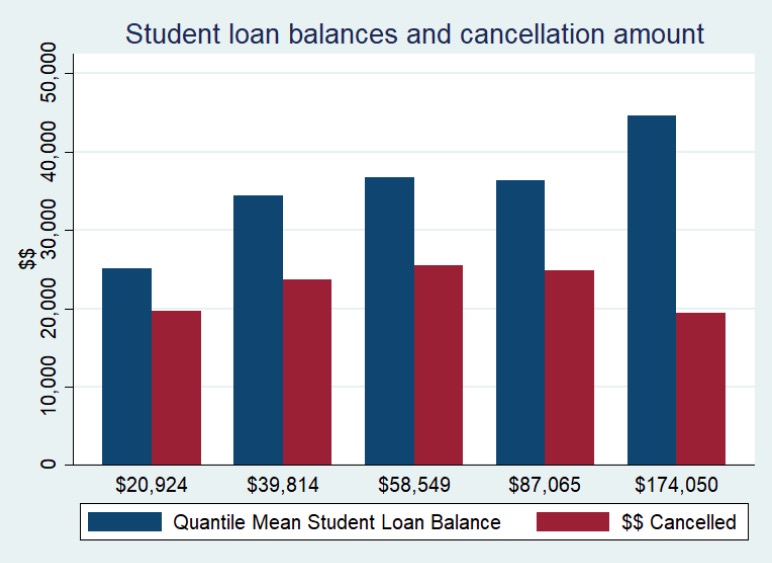

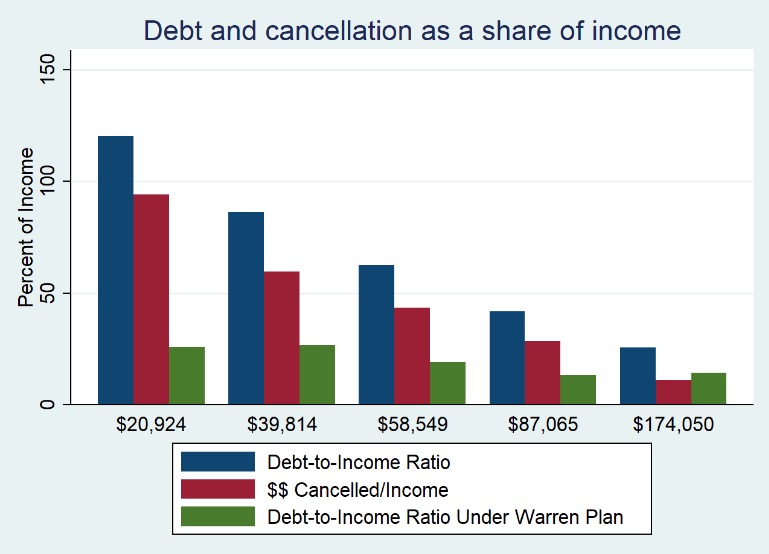

The Fuse Hidden Costs How Forgiveness Of Student Debt Could Reduce Vehicle Ownership The Fuse

The Fuse Hidden Costs How Forgiveness Of Student Debt Could Reduce Vehicle Ownership The Fuse

When student loans are forgiven borrowers may see a big tax bill at the end of the year. First the history of student debt cancellation reveals that for decades any cancellation was treated as a non-taxable scholarship and that likely continues to be the law applied to student loan interest subsidies. But theres a catch. The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income. Make note that this is not a retroactive law. Advocates and borrowers hope the change will.

However it is likely that such borrowers are insolvent with total debts exceeding total assets.

Any student loan cancellation is now tax-free through December 31 2025. In general if you have cancellation of debt income because your debt is canceled forgiven or discharged for less than the amount you must pay the amount of the canceled debt is taxable and you must report the canceled debt on your tax return for the year the cancellation occurs. The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income. In order to avail the loan an educational institution should be a regularly functioning institution. If a person to whom a student owes a debt cancels that debt that canceled amount will be taxable as students income. Primary co signer or both.

Any student loan cancellation is now tax-free through December 31 2025. Who reports as income. I was the co signer on a student loan. A loan taken by a student from an institution for the purpose of joining an educational institution is called student debt. Make note that this is not a retroactive law.

But theres a catch. First the history of student debt cancellation reveals that for decades any cancellation was treated as a non-taxable scholarship and that likely continues to be the law applied to student loan interest subsidies. Here are 10 tips about debt cancellation. Taxable student loan forgiveness and discharge. More notably for certain student borrowers it changes the tax exemption status of discharged student loans.

Total cancelled debt of 11400. If the borrower has to pay income taxes on that cancelled debt it could potentially cost several thousand dollars. In general if you have cancellation of debt income because your debt is canceled forgiven or discharged for less than the amount you must pay the amount of the canceled debt is taxable and you must report the canceled debt on your tax return for the year the cancellation occurs. The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income. But theres a catch.

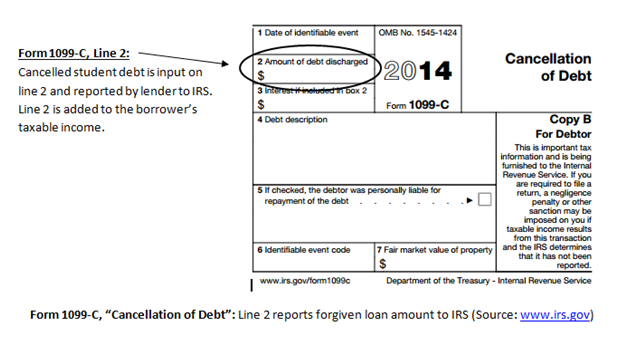

IRS Tax Tip 2017-23 March 2 2017. However it is likely that such borrowers are insolvent with total debts exceeding total assets. Any student loan debt that is discharged due to death or total and permanent disability TPD is no longer taxable. Student loan cancellation of debt often comes with tax consequences and a Form 1099-C. Advocates and borrowers hope the change will.

However the law allows an exclusion that may apply to homeowners who had their mortgage debt canceled in 2016. And in some cases insolvency for student loan forgiveness does allow people to. When you receive word that your student loans have been forgiven all or in part it can be a huge relief. IRS Tax Tip 2017-23 March 2 2017. Unfortunately some types of student loan cancellation and discharge are still taxable.

In order to avail the loan an educational institution should be a regularly functioning institution. If a lender cancels part or all of a debt a taxpayer must generally consider this as income. First the history of student debt cancellation reveals that for decades any cancellation was treated as a non-taxable scholarship and that likely continues to be the law applied to student loan interest subsidies. Primary co signer or both. Unfortunately some types of student loan cancellation and discharge are still taxable.

But theres a catch. However it is likely that such borrowers are insolvent with total debts exceeding total assets. Student loan cancellation of debt often comes with tax consequences and a Form 1099-C. Starting in 2018 President Trump made death and. Taxable student loan forgiveness and discharge.

Cancellation for False Certification of the loan Cancellation for unpaid refund of the loan If you receive a cancellation or discharge under these circumstances you will pay taxes on the amount of the student loan debt forgiven. More notably for certain student borrowers it changes the tax exemption status of discharged student loans. Formerly any student loan debt canceled by the government was considered taxable and levied at the borrowers normal income tax rate. Ordinarily with some exceptions if a student loan is canceled forgiven or discharged for less than the amount you owe the amount of the canceled debt is treated as taxable. The standard tax treatment of debt cancellation does not work with student loans for three principal reasons.

But theres a catch. I was the co signer on a student loan. However in many cases you might still owe taxes on the amount forgiven. Taxable student loan forgiveness and discharge. If the borrower has to pay income taxes on that cancelled debt it could potentially cost several thousand dollars.

However the law allows an exclusion that may apply to homeowners who had their mortgage debt canceled in 2016. The cancellation of the remaining debt after 20 or 25 years in repayment in an income-driven repayment plan is considered taxable income to the borrower under current law. As of January 2018 discharged student loan debt is no longer considered income. However it is likely that such borrowers are insolvent with total debts exceeding total assets. In order to avail the loan an educational institution should be a regularly functioning institution.

Here are 10 tips about debt cancellation. In general if you have cancellation of debt income because your debt is canceled forgiven or discharged for less than the amount you must pay the amount of the canceled debt is taxable and you must report the canceled debt on your tax return for the year the cancellation occurs. Debt Cancellation May be Taxable. Total cancelled debt of 11400. If the borrower has to pay income taxes on that cancelled debt it could potentially cost several thousand dollars.

A loan taken by a student from an institution for the purpose of joining an educational institution is called student debt. Who reports as income. As of January 2018 discharged student loan debt is no longer considered income. Formerly any student loan debt canceled by the government was considered taxable and levied at the borrowers normal income tax rate. Advocates and borrowers hope the change will.

As of January 2018 discharged student loan debt is no longer considered income. Ordinarily with some exceptions if a student loan is canceled forgiven or discharged for less than the amount you owe the amount of the canceled debt is treated as taxable. If a person to whom a student owes a debt cancels that debt that canceled amount will be taxable as students income. The cancellation of the remaining debt after 20 or 25 years in repayment in an income-driven repayment plan is considered taxable income to the borrower under current law. Here are 10 tips about debt cancellation.

The debt has been canceled. So if you get student loan cancellation from Congress or the president you would not owe any income tax on. First the history of student debt cancellation reveals that for decades any cancellation was treated as a non-taxable scholarship and that likely continues to be the law applied to student loan interest subsidies. As of January 2018 discharged student loan debt is no longer considered income. Make note that this is not a retroactive law.

I was the co signer on a student loan. Student loan cancellation of debt often comes with tax consequences and a Form 1099-C. Advocates and borrowers hope the change will. Debt Cancellation May be Taxable. The standard tax treatment of debt cancellation does not work with student loans for three principal reasons.

Total cancelled debt of 11400. More notably for certain student borrowers it changes the tax exemption status of discharged student loans. Who reports as income. This issue is currently in flux as there are proposals to make student loan forgiveness tax-free. But cancelled student loan debt is not always taxable.

The cancellation of the remaining debt after 20 or 25 years in repayment in an income-driven repayment plan is considered taxable income to the borrower under current law. The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income. Debt cancellation cannot be taxed in the event of a school closure under the Higher Education Act but they can be taxed if discharged due to death disability and situations in which the school is accused of fraud. However in many cases you might still owe taxes on the amount forgiven. If a person to whom a student owes a debt cancels that debt that canceled amount will be taxable as students income.

The standard tax treatment of debt cancellation does not work with student loans for three principal reasons. Here are 10 tips about debt cancellation. Make note that this is not a retroactive law. When student loans are forgiven borrowers may see a big tax bill at the end of the year. Student loan cancellation of debt often comes with tax consequences and a Form 1099-C.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is cancellation of student loan debt taxable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.