Your Irs student loan repayment program images are ready in this website. Irs student loan repayment program are a topic that is being searched for and liked by netizens now. You can Download the Irs student loan repayment program files here. Find and Download all free photos and vectors.

If you’re searching for irs student loan repayment program images information related to the irs student loan repayment program interest, you have pay a visit to the right site. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

Irs Student Loan Repayment Program. The PLR addressed an individual plan sponsors desire to amend their 401k plan to include a program for employees that were making student loan repayments. In mid-August the IRS issued a Private Letter Ruling PLR to an organization that utilized a student loan repayment program. To be eligible an employee must make a loan repayment of at least 2 percent of his or her eligible compensation for a pay period and be employed by the employer on the last day of the plan year. An IRS ruling may encourage more employers to provide a student loan repayment program that matches an employees loan payments with special employer 401k contributions.

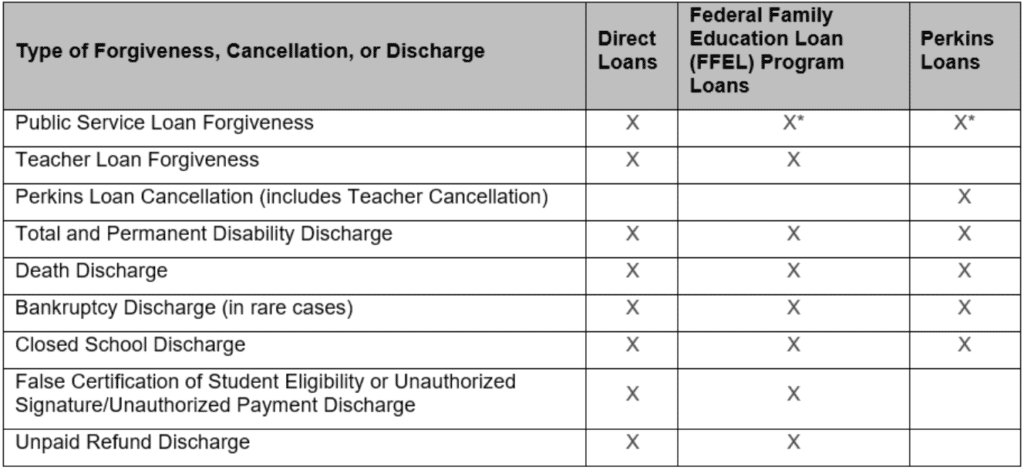

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

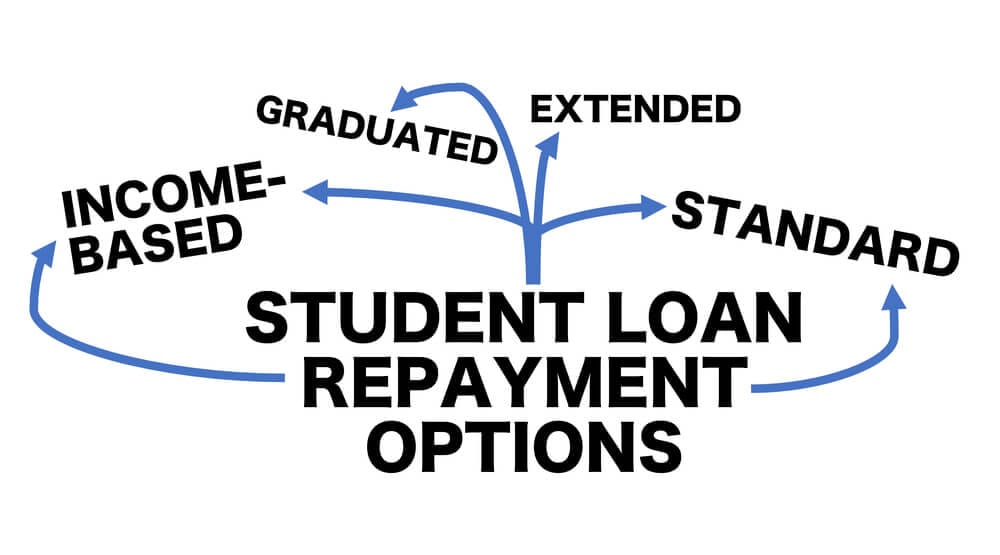

While there are a variety of student loan repayment programs available for employers to offer their employees one student loan repayment program recently received support from the Internal Revenue Service IRS. After the verification of the loan the organization provides the debtor with a registration number that can be shared with. The PLR addressed an individual plan sponsors desire to amend their 401k plan to include a program for employees that were making student loan repayments. To be eligible to claim the lifetime learning credit the law requires a taxpayer or a dependent to have received Form 1098-T Tuition Statement from an eligible educational institution whether domestic or foreignHowever you may claim the credit if the student doesnt receive a Form 1098-T because the students educational institution isnt required to furnish a Form 1098-T to the student under existing rules for example if the student. Federal student loan repayment plans include the Standard Extended Graduated Income-Based Pay As You Earn REPAYE Income-Contingent and Income-Sensitive plans. According to the IRSs latest tax rules any student loan forgiveness benefits that you receive will.

To be eligible employees must work at least 20 hours per week.

Under the program if an employee makes a student loan repayment during a pay period equal to at least 2 of the employees eligible compensation for the pay period then the plan sponsor will make an SLR non-elective contribution as soon as practicable after the end of the year equal to 5 of the employees eligible compensation for that pay period. 17 2018 the IRS issued private letter ruling 201833012 the PLR. Which ones should they consider implementing. In mid-August the IRS issued a Private Letter Ruling PLR to an organization that utilized a student loan repayment program. The panel will discuss recent legislation IRS guidance applicable rules and important design considerations for employers including the challenges in offering a student loan repayment program in connection with a 401k plan. Aetna offers student loan repayment assistance to employees with eligible loans that meet company guidelines.

An IRS ruling may encourage more employers to provide a student loan repayment program that matches an employees loan payments with special employer 401k contributions. If you repay your loans under a repayment plan based on your income any remaining balance on your student loans will be forgiven after you make a certain number of payments over a certain period of time. Aetna offers student loan repayment assistance to employees with eligible loans that meet company guidelines. IR-2020-11 January 15 2020 The IRS and Department of the Treasury issued Revenue Procedure 2020-11 that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school. According to the IRSs latest tax rules any student loan forgiveness benefits that you receive will.

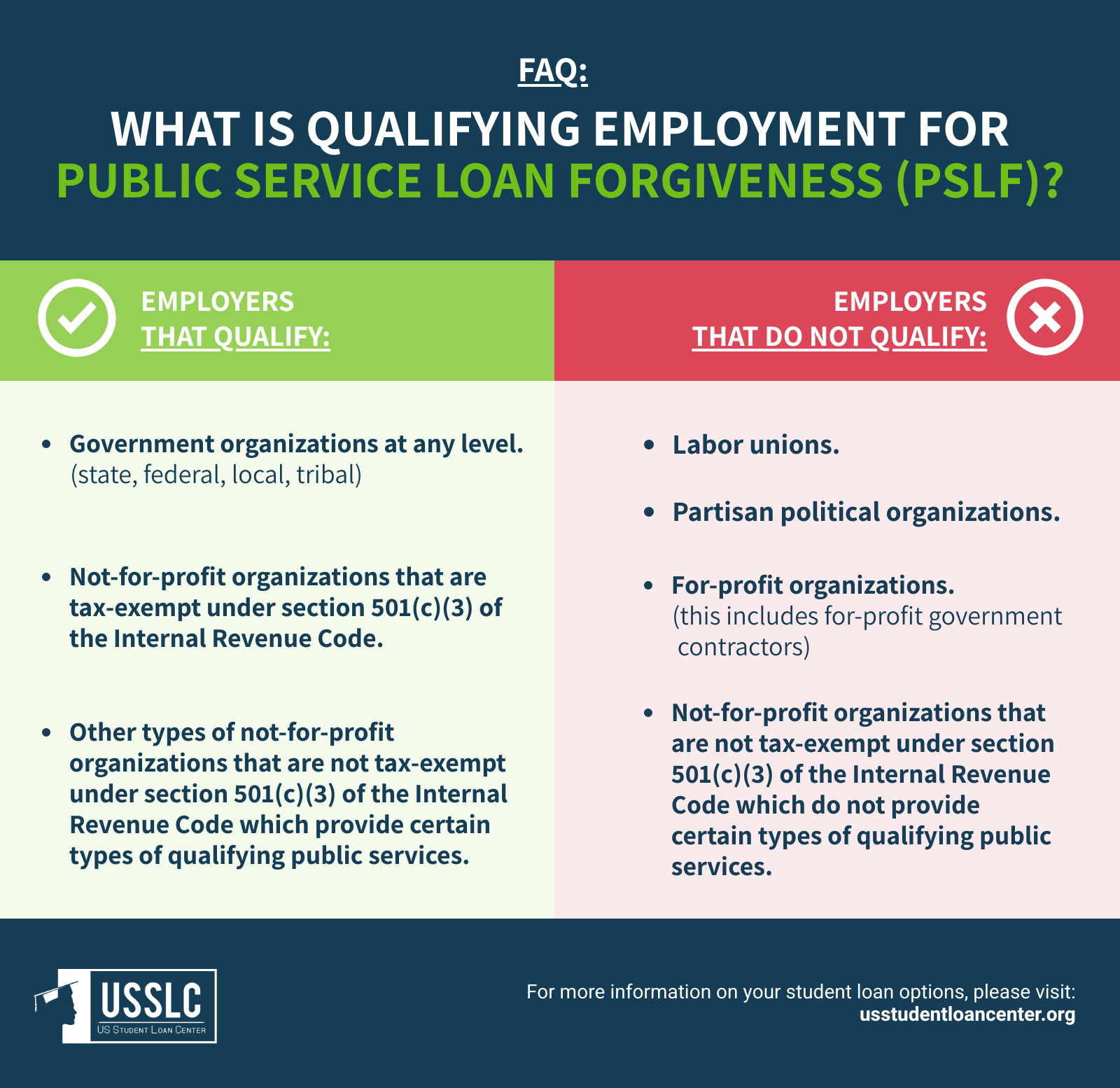

Unfortunately yes student loan forgiveness benefits are currently counted as taxable income by the IRS which means that in most cases youll end up having to pay a percentage of whatever amount of student loan debt you have forgiven to the IRS. 5379 which authorizes agencies to set up their own student loan repayment programs to attract or retain highly qualified employees. One type of student loan debt repayment program offered by some defined contribution DC plan sponsors. The program implements 5 USC. The panel will discuss recent legislation IRS guidance applicable rules and important design considerations for employers including the challenges in offering a student loan repayment program in connection with a 401k plan.

Under the program if an employee makes a student loan repayment during a pay period equal to at least 2 of the employees eligible compensation for the pay period then the plan sponsor will make an SLR non-elective contribution as soon as practicable after the end of the year equal to 5 of the employees eligible compensation for that pay period. Feasibility of implementing a system for the repayment of Federal student loans through wage withholding or other means involving the IRS. The program implements 5 USC. The panel will discuss recent legislation IRS guidance applicable rules and important design considerations for employers including the challenges in offering a student loan repayment program in connection with a 401k plan. Whether the IRS could implement such a system of student loan repayment.

To be eligible employees must work at least 20 hours per week. Income-Driven Repayment IDR Plan. From student loan refinancing and forgiveness programs to employer-sponsored repayment approaches employers wanting to offer student loan repayment benefits to employees have a multitude of selections to sift through. If you repay your loans under a repayment plan based on your income any remaining balance on your student loans will be forgiven after you make a certain number of payments over a certain period of time. In mid-August the IRS issued a Private Letter Ruling PLR to an organization that utilized a student loan repayment program.

Learn more about IDR plans and how to. Feasibility of implementing a system for the repayment of Federal student loans through wage withholding or other means involving the IRS. The Report asked that the study include analyses which would help determine. To be eligible an employee must make a loan repayment of at least 2 percent of his or her eligible compensation for a pay period and be employed by the employer on the last day of the plan year. The PLR addressed an individual plan sponsors desire to amend their 401k plan to include a program for employees that were making student loan repayments.

5379 which authorizes agencies to set up their own student loan repayment programs to attract or retain highly qualified employees. IR-2020-11 January 15 2020 The IRS and Department of the Treasury issued Revenue Procedure 2020-11 that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school. Under the program if an employee makes a student loan repayment during a pay period equal to at least 2 of the employees eligible compensation for the pay period then the plan sponsor will make an SLR non-elective contribution as soon as practicable after the end of the year equal to 5 of the employees eligible compensation for that pay period. The Federal student loan repayment program permits agencies to repay Federally insured student loans as a recruitment or retention incentive for candidates or current employees of the agency. 5379 which authorizes agencies to set up their own student loan repayment programs to attract or retain highly qualified employees.

The Report asked that the study include analyses which would help determine. Aetna offers student loan repayment assistance to employees with eligible loans that meet company guidelines. The form of this benefit would be an employer nonelective contribution. Learn more about IDR plans and how to. If you repay your loans under a repayment plan based on your income any remaining balance on your student loans will be forgiven after you make a certain number of payments over a certain period of time.

After the verification of the loan the organization provides the debtor with a registration number that can be shared with. 5379 which authorizes agencies to set up their own student loan repayment programs to attract or retain highly qualified employees. An IRS ruling may encourage more employers to provide a student loan repayment program that matches an employees loan payments with special employer 401k contributions. Under the program student loan debtors register with the organization and upload copies of their student loan repayment statements. It will start providing a 2000 annual match for employee student loan payments maxing out the benefit at 10000.

In mid-August the IRS issued a Private Letter Ruling PLR to an organization that utilized a student loan repayment program. According to the IRSs latest tax rules any student loan forgiveness benefits that you receive will. Which ones should they consider implementing. Feasibility of implementing a system for the repayment of Federal student loans through wage withholding or other means involving the IRS. Unfortunately yes student loan forgiveness benefits are currently counted as taxable income by the IRS which means that in most cases youll end up having to pay a percentage of whatever amount of student loan debt you have forgiven to the IRS.

Federal student loan repayment plans include the Standard Extended Graduated Income-Based Pay As You Earn REPAYE Income-Contingent and Income-Sensitive plans. The panel will discuss recent legislation IRS guidance applicable rules and important design considerations for employers including the challenges in offering a student loan repayment program in connection with a 401k plan. After the verification of the loan the organization provides the debtor with a registration number that can be shared with. To be eligible an employee must make a loan repayment of at least 2 percent of his or her eligible compensation for a pay period and be employed by the employer on the last day of the plan year. IR-2020-11 January 15 2020 The IRS and Department of the Treasury issued Revenue Procedure 2020-11 that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school.

It will start providing a 2000 annual match for employee student loan payments maxing out the benefit at 10000. The Federal student loan repayment program permits agencies to repay Federally insured student loans as a recruitment or retention incentive for candidates or current employees of the agency. 17 2018 the IRS issued private letter ruling 201833012 the PLR. The Report asked that the study include analyses which would help determine. It will start providing a 2000 annual match for employee student loan payments maxing out the benefit at 10000.

Under the program if an employee makes a student loan repayment during a pay period equal to at least 2 of the employees eligible compensation for the pay period then the plan sponsor will make an SLR non-elective contribution as soon as practicable after the end of the year equal to 5 of the employees eligible compensation for that pay period. Under the program student loan debtors register with the organization and upload copies of their student loan repayment statements. The Federal student loan repayment program permits agencies to repay Federally insured student loans as a recruitment or retention incentive for candidates or current employees of the agency. According to the IRSs latest tax rules any student loan forgiveness benefits that you receive will. Under the program if an employee makes a student loan repayment during a pay period equal to at least 2 of the employees eligible compensation for the pay period then the plan sponsor will make an SLR non-elective contribution as soon as practicable after the end of the year equal to 5 of the employees eligible compensation for that pay period.

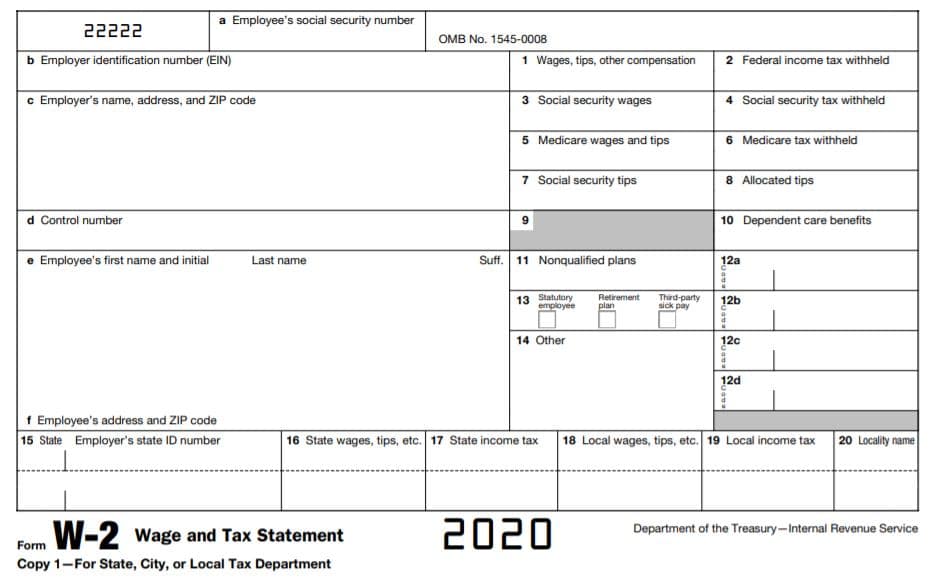

To be eligible to claim the lifetime learning credit the law requires a taxpayer or a dependent to have received Form 1098-T Tuition Statement from an eligible educational institution whether domestic or foreignHowever you may claim the credit if the student doesnt receive a Form 1098-T because the students educational institution isnt required to furnish a Form 1098-T to the student under existing rules for example if the student. An IRS ruling may encourage more employers to provide a student loan repayment program that matches an employees loan payments with special employer 401k contributions. IR-2020-11 January 15 2020 The IRS and Department of the Treasury issued Revenue Procedure 2020-11 that establishes a safe harbor extending relief to additional taxpayers who took out federal or private student loans to finance attendance at a nonprofit or for-profit school. The PLR addressed an individual plan sponsors desire to amend their 401k plan to include a program for employees that were making student loan repayments. Whether the IRS could implement such a system of student loan repayment.

To be eligible an employee must make a loan repayment of at least 2 percent of his or her eligible compensation for a pay period and be employed by the employer on the last day of the plan year. Under the program if an employee makes a student loan repayment during a pay period equal to at least 2 of the employees eligible compensation for the pay period then the plan sponsor will make an SLR non-elective contribution as soon as practicable after the end of the year equal to 5 of the employees eligible compensation for that pay period. 5379 which authorizes agencies to set up their own student loan repayment programs to attract or retain highly qualified employees. This CLE webinar will guide employee benefits attorneys on structuring student loan repayment benefit programs. Aetna offers student loan repayment assistance to employees with eligible loans that meet company guidelines.

The program implements 5 USC. From student loan refinancing and forgiveness programs to employer-sponsored repayment approaches employers wanting to offer student loan repayment benefits to employees have a multitude of selections to sift through. Unfortunately yes student loan forgiveness benefits are currently counted as taxable income by the IRS which means that in most cases youll end up having to pay a percentage of whatever amount of student loan debt you have forgiven to the IRS. If you repay your loans under a repayment plan based on your income any remaining balance on your student loans will be forgiven after you make a certain number of payments over a certain period of time. IRS to Issue Formal Guidance on Student Loan Repayment Programs May 14 2019 by Lyndsey Barnett At a conference late last week an IRS official announced that the IRS was working on guidance to answer the many questions that it has received after the issuance of the PLR last August approving a unique student loan repayment arrangement inside of a retirement plan.

One type of student loan debt repayment program offered by some defined contribution DC plan sponsors. According to the IRSs latest tax rules any student loan forgiveness benefits that you receive will. Federal student loan repayment plans include the Standard Extended Graduated Income-Based Pay As You Earn REPAYE Income-Contingent and Income-Sensitive plans. Aetna offers student loan repayment assistance to employees with eligible loans that meet company guidelines. Under the program student loan debtors register with the organization and upload copies of their student loan repayment statements.

Federal student loan repayment plans include the Standard Extended Graduated Income-Based Pay As You Earn REPAYE Income-Contingent and Income-Sensitive plans. If you repay your loans under a repayment plan based on your income any remaining balance on your student loans will be forgiven after you make a certain number of payments over a certain period of time. The Report asked that the study include analyses which would help determine. To be eligible to claim the lifetime learning credit the law requires a taxpayer or a dependent to have received Form 1098-T Tuition Statement from an eligible educational institution whether domestic or foreignHowever you may claim the credit if the student doesnt receive a Form 1098-T because the students educational institution isnt required to furnish a Form 1098-T to the student under existing rules for example if the student. Which ones should they consider implementing.

The panel will discuss recent legislation IRS guidance applicable rules and important design considerations for employers including the challenges in offering a student loan repayment program in connection with a 401k plan. Whether the IRS could implement such a system of student loan repayment. This CLE webinar will guide employee benefits attorneys on structuring student loan repayment benefit programs. 17 2018 the IRS issued private letter ruling 201833012 the PLR. It will start providing a 2000 annual match for employee student loan payments maxing out the benefit at 10000.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title irs student loan repayment program by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.