Your If i get married will my student loan repayment increase images are available in this site. If i get married will my student loan repayment increase are a topic that is being searched for and liked by netizens today. You can Download the If i get married will my student loan repayment increase files here. Find and Download all free vectors.

If you’re searching for if i get married will my student loan repayment increase pictures information connected with to the if i get married will my student loan repayment increase keyword, you have come to the ideal blog. Our website always provides you with hints for viewing the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

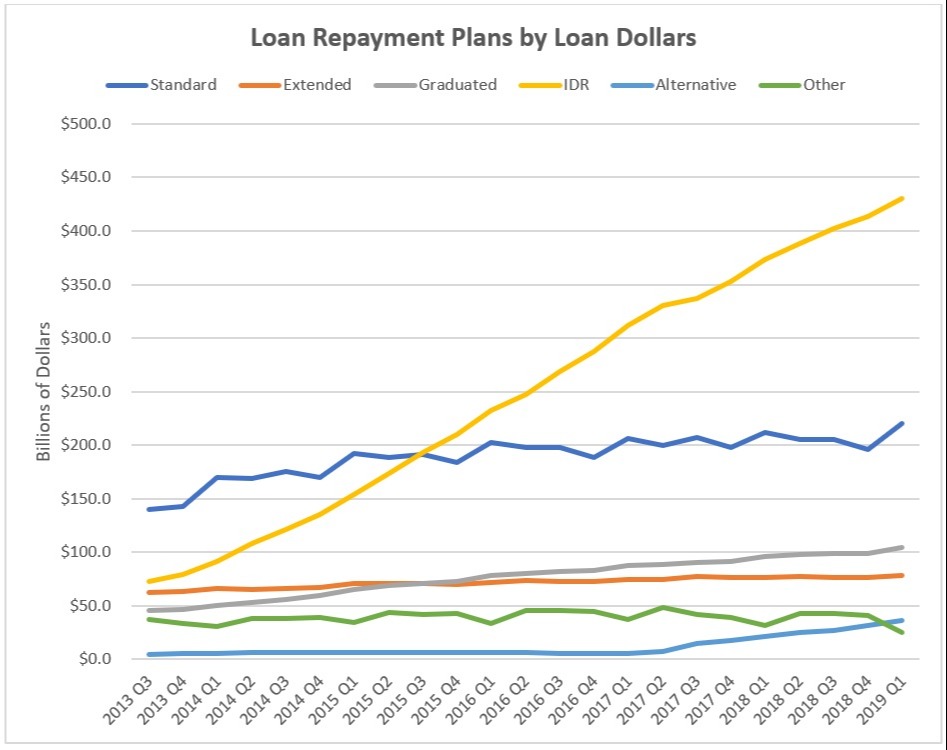

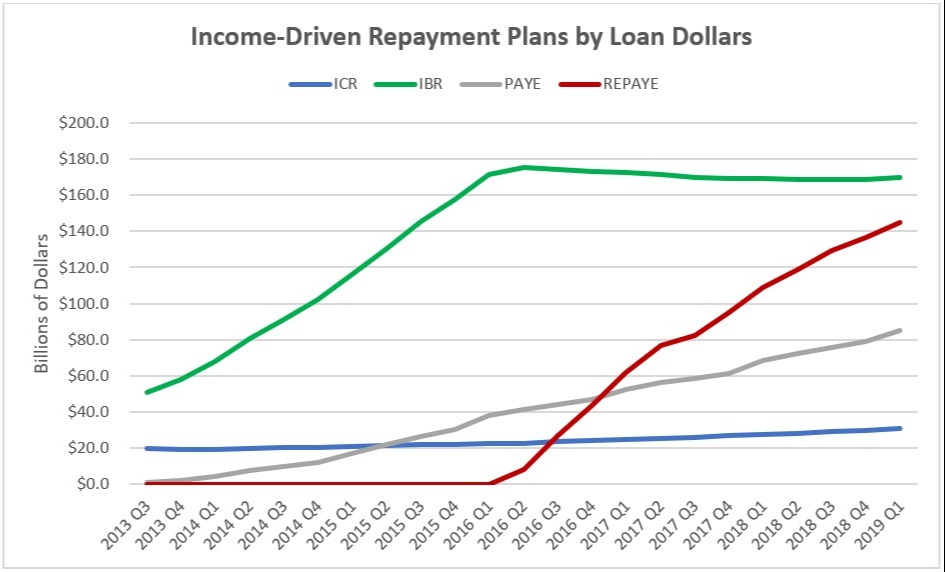

If I Get Married Will My Student Loan Repayment Increase. If one spouse has federal student loans and is enrolled in an income-driven repayment plan and the other isnt getting married can cause an. Married-Filing-Joint would significantly increase Spouse 1s student loan payment to about 35 of their take-home pay. Last but not least if you or your spouse are on an income-driven repayment plan to manage student debt marriage could bring changes to your monthly payments. Eligibility for certain repayment plans may change.

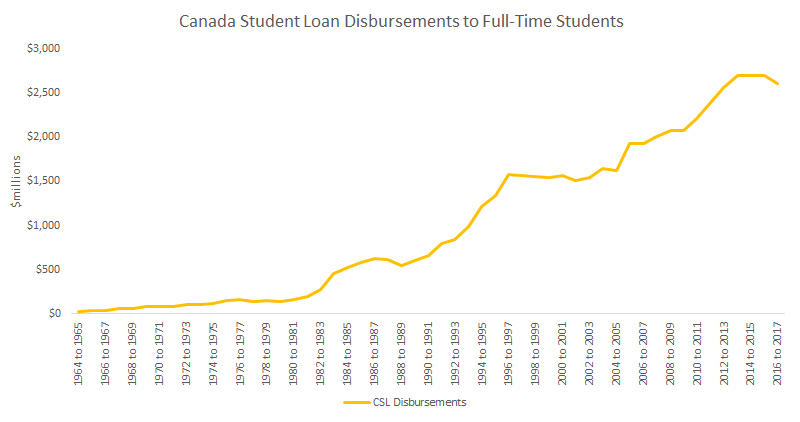

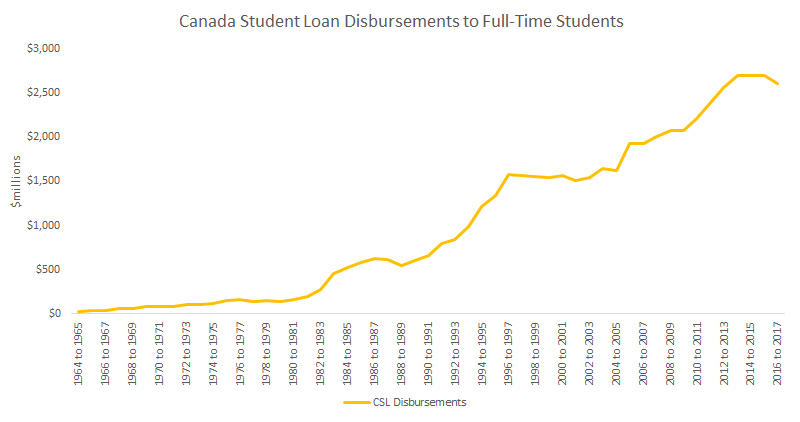

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

Student Debt Crisis 1 In 6 Canadian Bankruptcies Due To Student Debt Study

Monthly student loan payments. If youre on an income-driven repayment plan for your federal student loans getting married could affect your payments. The reasons for this are two-fold. If you file jointly the maximum deduction doesnt increase. Student Loans before Marriage Student loans you acquired before you get married have no bearing on your spouse. If you file your taxes as married filing jointly your income and your spouses income will be combined into one adjusted gross income.

If you do repay them it will help your credit rather than your.

If you do repay them it will help your credit rather than your. As a result your bill could increase significantly. You can avoid this by filing your taxes separately when youre married rather than jointly. Monthly student loan payments. But then they will lose some of the tax benefits available to borrowers who file joint returns including the student loan interest deduction. When you file your federal income taxes you can take a tax deduction for the interest paid on.

The maximum student loan interest deduction is 2500. If one spouse pays 10 of their discretionary income on a 50000 salary while the other spouse pays 10 on a 40000 salary it is roughly the same as paying a total of 10 on a combined 90000. The interest paid on student loans for the year. Eligibility for certain repayment plans may change. You are responsible for their repayment and if you dont repay them it will only harm your credit and potentially garnish your wages.

But then they will lose some of the tax benefits available to borrowers who file joint returns including the student loan interest deduction. In fact I frequently get calls regarding student loans after a recent marriage. If you file your taxes as married filing jointly your income and your spouses income will be combined into one adjusted gross income. Marriage will often have a negative impact on your financial aid reward if you are 24 or over and your spouse has significant income. The fact that student loans are preventing people from getting married seems ridiculous but its a fact that exists none-the-less.

Married borrowers have a choice. Eligibility for certain repayment plans may change. The maximum student loan interest deduction is 2500. Getting married may cause changes in student loan payments but as a couple your combined income-driven payments should remain approximately the same. Other things you wont be able to claim if you file separately include the Earned Income Tax Credit Adoption Tax Credit and Lifetime Learning Credit.

Simply put getting married will increase your spouses total household income if you earn a paycheck. You can avoid this by filing your taxes separately when youre married rather than jointly. Spouse 2 with no student debt makes a higher income than Spouse 1. If youre married and file a joint tax return your monthly student loan payment is calculated on your joint AGI. Getting married may cause changes in student loan payments but as a couple your combined income-driven payments should remain approximately the same.

Marriage will often have a negative impact on your financial aid reward if you are 24 or over and your spouse has significant income. If youre married and file a joint tax return your monthly student loan payment is calculated on your joint AGI. My friend was not the first to delay getting married because of student debt concerns. In fact I frequently get calls regarding student loans after a recent marriage. If youre married and filing jointly you can deduct up to 2500 worth of student loan interest from your taxable income.

Since IDR uses taxes to determine how much you pay per month a higher household income could mean a higher loan payment under an IDR plan. If youre on an income-based repayment IBR plan for federal student loans your monthly payments may increase when you get married. You are responsible for their repayment and if you dont repay them it will only harm your credit and potentially garnish your wages. You can avoid this by filing your taxes separately when youre married rather than jointly. So a simple way to potentially lower your student loan payment and increase your potential student loan forgiveness is to lower your AGI - and married couples can potentially do this by filing separately versus jointly.

So a simple way to potentially lower your student loan payment and increase your potential student loan forgiveness is to lower your AGI - and married couples can potentially do this by filing separately versus jointly. Eligibility for certain repayment plans may change. If they choose to file federal income tax returns as married filing separately they can have only their individual income counted for income-based repayment. If you are married and file your taxes jointlywhich the vast majority of couples doyour payment will be based on your combined adjusted gross income AGI. Spouse 2 with no student debt makes a higher income than Spouse 1.

Eligibility for certain repayment plans may change. Other things you wont be able to claim if you file separately include the Earned Income Tax Credit Adoption Tax Credit and Lifetime Learning Credit. Married borrowers have a choice. In fact I frequently get calls regarding student loans after a recent marriage. You are responsible for their repayment and if you dont repay them it will only harm your credit and potentially garnish your wages.

My friend was not the first to delay getting married because of student debt concerns. The fact that student loans are preventing people from getting married seems ridiculous but its a fact that exists none-the-less. This client had other higher interest debt in the mix to prioritize paying off ASAP - available cash flow is important here. If they choose to file federal income tax returns as married filing separately they can have only their individual income counted for income-based repayment. If one spouse pays 10 of their discretionary income on a 50000 salary while the other spouse pays 10 on a 40000 salary it is roughly the same as paying a total of 10 on a combined 90000.

Thus even though you might have to pay more interest each month after you get married you wont get to deduct anything additional from your income. If one spouse has federal student loans and is enrolled in an income-driven repayment plan and the other isnt getting married can cause an. The maximum student loan interest deduction is 2500. Marriage will often have a negative impact on your financial aid reward if you are 24 or over and your spouse has significant income. As a result your bill could increase significantly.

The interest paid on student loans for the year. If youre on an income-driven repayment plan for your federal student loans getting married could affect your payments. Marriage will often have a negative impact on your financial aid reward if you are 24 or over and your spouse has significant income. This client had other higher interest debt in the mix to prioritize paying off ASAP - available cash flow is important here. My friend was not the first to delay getting married because of student debt concerns.

If you do repay them it will help your credit rather than your. Other things you wont be able to claim if you file separately include the Earned Income Tax Credit Adoption Tax Credit and Lifetime Learning Credit. If you file jointly the maximum deduction doesnt increase. Thus even though you might have to pay more interest each month after you get married you wont get to deduct anything additional from your income. If they choose to file federal income tax returns as married filing separately they can have only their individual income counted for income-based repayment.

You are responsible for their repayment and if you dont repay them it will only harm your credit and potentially garnish your wages. If youre married and file a joint tax return your monthly student loan payment is calculated on your joint AGI. If youre married and filing jointly you can deduct up to 2500 worth of student loan interest from your taxable income. The maximum student loan interest deduction is 2500. Since IDR uses taxes to determine how much you pay per month a higher household income could mean a higher loan payment under an IDR plan.

Simply put getting married will increase your spouses total household income if you earn a paycheck. Monthly student loan payments. If you are 24 or over you are considered to have independent status for financial aid. If you file jointly the maximum deduction doesnt increase. The maximum student loan interest deduction is 2500.

Last but not least if you or your spouse are on an income-driven repayment plan to manage student debt marriage could bring changes to your monthly payments. If youre on an income-driven repayment plan for your federal student loans getting married could affect your payments. The maximum student loan interest deduction is 2500. If youre married and filing jointly you can deduct up to 2500 worth of student loan interest from your taxable income. The interest paid on student loans for the year.

If youre married and file a joint tax return your monthly student loan payment is calculated on your joint AGI. Spouse 2 with no student debt makes a higher income than Spouse 1. Last but not least if you or your spouse are on an income-driven repayment plan to manage student debt marriage could bring changes to your monthly payments. Student Loans before Marriage Student loans you acquired before you get married have no bearing on your spouse. IBR plans are calculated based on your household size and income so depending on your filing status the government may factor your spouses salary in when determining how much you can afford to pay.

But then they will lose some of the tax benefits available to borrowers who file joint returns including the student loan interest deduction. Married borrowers have a choice. Getting married can also affect the tax break that you receive for repaying your student loans. You are responsible for their repayment and if you dont repay them it will only harm your credit and potentially garnish your wages. The maximum student loan interest deduction is 2500.

You are responsible for their repayment and if you dont repay them it will only harm your credit and potentially garnish your wages. If you file your taxes as married filing jointly your income and your spouses income will be combined into one adjusted gross income. You are responsible for their repayment and if you dont repay them it will only harm your credit and potentially garnish your wages. Other things you wont be able to claim if you file separately include the Earned Income Tax Credit Adoption Tax Credit and Lifetime Learning Credit. The interest paid on student loans for the year.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title if i get married will my student loan repayment increase by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.