Your How to get a cosigner off your student loan images are ready in this website. How to get a cosigner off your student loan are a topic that is being searched for and liked by netizens today. You can Download the How to get a cosigner off your student loan files here. Download all free photos and vectors.

If you’re searching for how to get a cosigner off your student loan images information related to the how to get a cosigner off your student loan interest, you have come to the ideal site. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

How To Get A Cosigner Off Your Student Loan. When a loan allows cosigner release the lender sets conditions up front. The cosigner release option is probably one of the easiest methods of taking a co-signers name off a car loan. Typically a co-signer release for a student loan is available after the student makes a certain number of consecutive on-time payments and submits an application to the lender. Federal student loan programs recognize that you are in fact a student and lack the income and credit profile typically required to support the loan.

How To Get A Student Loan Cosigner Release Lendedu Student Loan Forgiveness Student Loans Funny Student Loans

How To Get A Student Loan Cosigner Release Lendedu Student Loan Forgiveness Student Loans Funny Student Loans

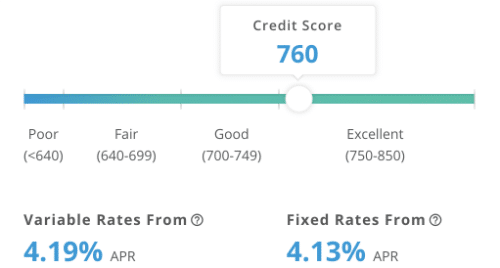

One of the best ways to get your name removed as a co-signer is to have the loan refinanced in the primary borrowers name which will essentially replace one loan with another usually with a lower interest payment or better terms. You will have to meet the requirements set by the new lender to qualify for student loan refinancing. Check with your lenders website searching for the term student loan cosigner release Failing that you may need to call the bank student loan lending department. If you sell the car you can use the money to pay off the loan. Your child must be able to demonstrate that they make enough money to cover the loan payments and their credit score must meet the lenders minimum. PNC Bank Cosigner can be released after 48.

Permanent resident alien at the time you submit the cosigner release request.

If you dont qualify for co-signer release or your lender doesnt offer it there are a few alternatives to consider that may help release your co-signer from responsibility sooner. Some loans have a program that will release a cosigners obligation after a certain number of consecutive on-time payments have been made. One of the best ways to get your name removed as a co-signer is to have the loan refinanced in the primary borrowers name which will essentially replace one loan with another usually with a lower interest payment or better terms. If you sell the car you can use the money to pay off the loan. Cosigner release can allow you to remove a cosigner from your private student loans after making a set number of consecutive payments. Provide proof of graduation or completion of a certification program such as a copy of your diploma andor transcript for the loan s from which you want your cosigner to be released.

Cosigner release can allow you to remove a cosigner from your private student loans after making a set number of consecutive payments. To avoid one of those nasty auto-default situations the CFPB suggests should try to get the co-signer released from the loan and co-signers should make efforts to get off the loans when possible. When you refinance the old loan is paid off and you will start paying what you owe based on new terms. If you sell the car you can use the money to pay off the loan. If you take out private student loans with a cosigner you may be able to have them removed from the loan.

Permanent resident alien at the time you submit the cosigner release request. Repayment is based on your securing employment after graduation. As a high school student you may not have an established credit history so you may need to add a cosigner to your private student loan. One of the best ways to get your name removed as a co-signer is to have the loan refinanced in the primary borrowers name which will essentially replace one loan with another usually with a lower interest payment or better terms. DCU Credit Union Student Choice Cosigner can be released after 48 months of on-time payments.

Many banks and lenders offer cosigners the opportunity to be released from a private student loan but borrowers need to be sure the option is available before consummating the loan. Your child must be able to demonstrate that they make enough money to cover the loan payments and their credit score must meet the lenders minimum. Some loans have a program that will release a cosigners obligation after a certain number of consecutive on-time payments have been made. As a high school student you may not have an established credit history so you may need to add a cosigner to your private student loan. You may need to speak with several parties in.

The cosigner release option is probably one of the easiest methods of taking a co-signers name off a car loan. As a high school student you may not have an established credit history so you may need to add a cosigner to your private student loan. Cosigner release can allow you to remove a cosigner from your private student loans after making a set number of consecutive payments. To avoid one of those nasty auto-default situations the CFPB suggests should try to get the co-signer released from the loan and co-signers should make efforts to get off the loans when possible. Repayment is based on your securing employment after graduation.

Cosigner release can allow you to remove a cosigner from your private student loans after making a set number of consecutive payments. Typically a co-signer release for a student loan is available after the student makes a certain number of consecutive on-time payments and submits an application to the lender. Check with your lenders website searching for the term student loan cosigner release Failing that you may need to call the bank student loan lending department. To apply for a student loan cosigner release your child must have proof of their completed degree such as a copy of a diploma or official transcript. Federal student loan programs recognize that you are in fact a student and lack the income and credit profile typically required to support the loan.

You will have to meet the requirements set by the new lender to qualify for student loan refinancing. Repayment is based on your securing employment after graduation. Many banks and lenders offer cosigners the opportunity to be released from a private student loan but borrowers need to be sure the option is available before consummating the loan. If you do be sure to be both patient and persistent. When a loan allows cosigner release the lender sets conditions up front.

As a high school student you may not have an established credit history so you may need to add a cosigner to your private student loan. Provide proof of graduation or completion of a certification program such as a copy of your diploma andor transcript for the loan s from which you want your cosigner to be released. Repayment is based on your securing employment after graduation. A cosigner is someone who agrees to take equal responsibility for your student loan. To apply for a student loan cosigner release your child must have proof of their completed degree such as a copy of a diploma or official transcript.

Those that do offer this escape clause typically require borrowers to make a minimum number of consecutive on-time payments usually between 24 and 48 months. Check with your lenders website searching for the term student loan cosigner release Failing that you may need to call the bank student loan lending department. Your child has graduated. If you dont qualify for co-signer release or your lender doesnt offer it there are a few alternatives to consider that may help release your co-signer from responsibility sooner. For mortgages car loans and student loans the process for refinancing is pretty straightforward.

That means if you dont make your payments on time your cosigner will need to cover your debt. To apply for a student loan cosigner release your child must have proof of their completed degree such as a copy of a diploma or official transcript. Many banks and lenders offer cosigners the opportunity to be released from a private student loan but borrowers need to be sure the option is available before consummating the loan. That means if you dont make your payments on time your cosigner will need to cover your debt. If you do be sure to be both patient and persistent.

One of the best ways to get your name removed as a co-signer is to have the loan refinanced in the primary borrowers name which will essentially replace one loan with another usually with a lower interest payment or better terms. DCU Credit Union Student Choice Cosigner can be released after 48 months of on-time payments. Federal Student Loans Most federal student loans will enable you to qualify even without a cosigner. And many private student loan lender advertise it is possible for a co-signer to be released from the student loan but make it a complicated and unwieldily process. When a loan allows cosigner release the lender sets conditions up front.

If you dont qualify for co-signer release or your lender doesnt offer it there are a few alternatives to consider that may help release your co-signer from responsibility sooner. Federal Student Loans Most federal student loans will enable you to qualify even without a cosigner. Federal student loan programs recognize that you are in fact a student and lack the income and credit profile typically required to support the loan. Typically a co-signer release for a student loan is available after the student makes a certain number of consecutive on-time payments and submits an application to the lender. Many banks and lenders offer cosigners the opportunity to be released from a private student loan but borrowers need to be sure the option is available before consummating the loan.

Permanent resident alien at the time you submit the cosigner release request. Federal Student Loans Most federal student loans will enable you to qualify even without a cosigner. Check with your lenders website searching for the term student loan cosigner release Failing that you may need to call the bank student loan lending department. When you refinance the old loan is paid off and you will start paying what you owe based on new terms. DCU Credit Union Student Choice Cosigner can be released after 48 months of on-time payments.

If you dont qualify for co-signer release or your lender doesnt offer it there are a few alternatives to consider that may help release your co-signer from responsibility sooner. Repayment is based on your securing employment after graduation. If the conditions are met the lender will remove the cosigner from the loan. Federal Student Loans Most federal student loans will enable you to qualify even without a cosigner. Sallie Mae for example allows student loan borrowers to apply for a cosigner release after 12 months of payments if credit and other requirements are met.

Cosigner release can allow you to remove a cosigner from your private student loans after making a set number of consecutive payments. Typically a co-signer release for a student loan is available after the student makes a certain number of consecutive on-time payments and submits an application to the lender. You will have to meet the requirements set by the new lender to qualify for student loan refinancing. While getting a student loan without a cosigner may be ideal its not always possible. If you do be sure to be both patient and persistent.

Pay Off the Loan Another option to get a cosigner off a car loan is to pay off the loan either directly or by selling the car. For mortgages car loans and student loans the process for refinancing is pretty straightforward. If the conditions are met the lender will remove the cosigner from the loan. You will have to meet the requirements set by the new lender to qualify for student loan refinancing. Provide proof of graduation or completion of a certification program such as a copy of your diploma andor transcript for the loan s from which you want your cosigner to be released.

For mortgages car loans and student loans the process for refinancing is pretty straightforward. And many private student loan lender advertise it is possible for a co-signer to be released from the student loan but make it a complicated and unwieldily process. Check with your lenders website searching for the term student loan cosigner release Failing that you may need to call the bank student loan lending department. When you refinance the old loan is paid off and you will start paying what you owe based on new terms. Federal Student Loans Most federal student loans will enable you to qualify even without a cosigner.

Check with your lenders website searching for the term student loan cosigner release Failing that you may need to call the bank student loan lending department. One of the best ways to get your name removed as a co-signer is to have the loan refinanced in the primary borrowers name which will essentially replace one loan with another usually with a lower interest payment or better terms. Many banks and lenders offer cosigners the opportunity to be released from a private student loan but borrowers need to be sure the option is available before consummating the loan. Your child has graduated. Pay Off the Loan Another option to get a cosigner off a car loan is to pay off the loan either directly or by selling the car.

Your child has graduated. As a high school student you may not have an established credit history so you may need to add a cosigner to your private student loan. If the conditions are met the lender will remove the cosigner from the loan. For mortgages car loans and student loans the process for refinancing is pretty straightforward. Your child has a sufficient credit score and proof of income.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to get a cosigner off your student loan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.