Your How to fix defaulted private student loans images are available in this site. How to fix defaulted private student loans are a topic that is being searched for and liked by netizens now. You can Find and Download the How to fix defaulted private student loans files here. Get all royalty-free vectors.

If you’re looking for how to fix defaulted private student loans pictures information related to the how to fix defaulted private student loans topic, you have visit the right blog. Our website frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

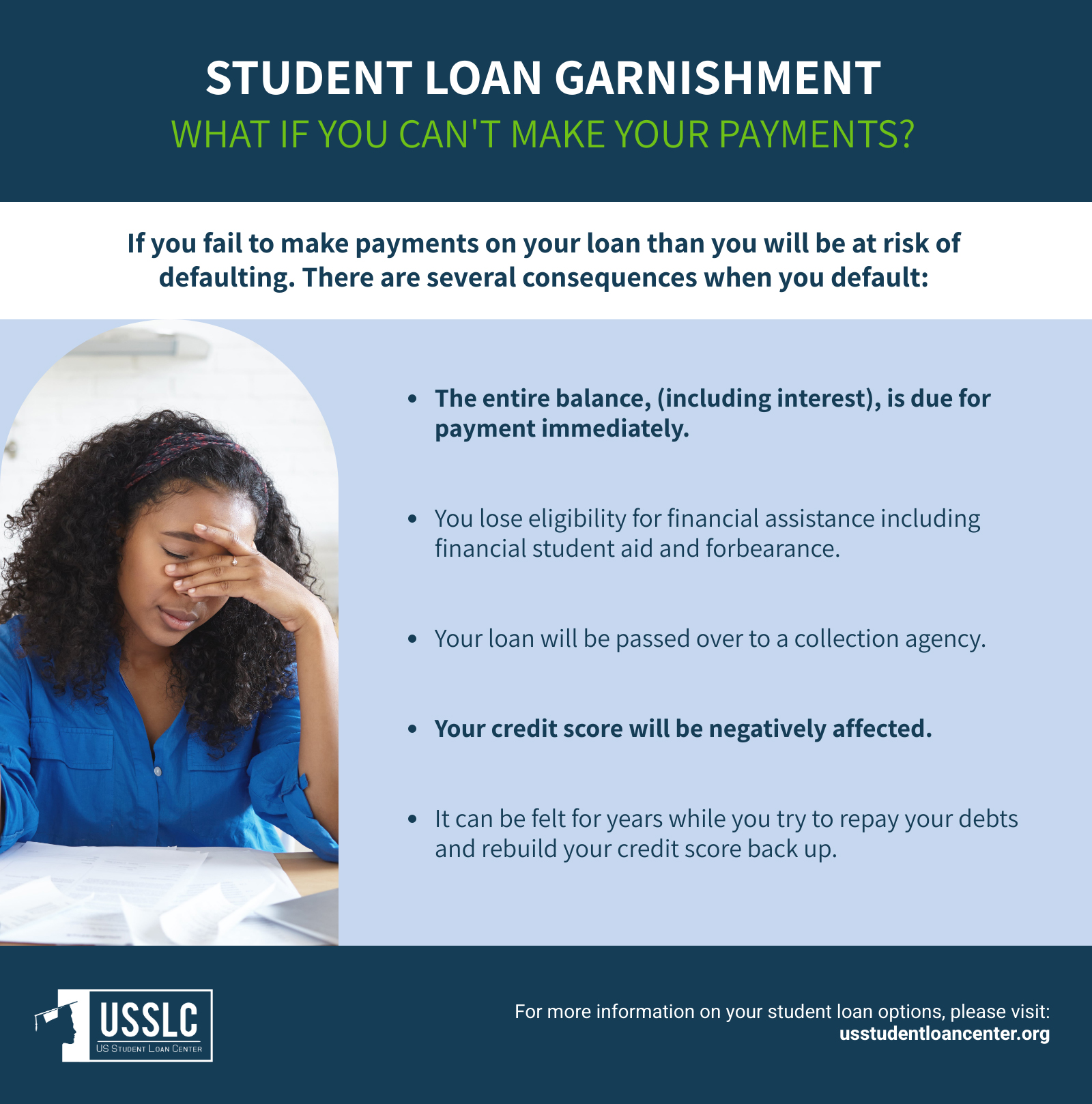

How To Fix Defaulted Private Student Loans. Now in order to get your student loans out of default you have four options. For federal student loans a borrower isnt considered to. This will stop you from qualifying for credit cards cars and a home for at least three years. 6 options for handling private student loan default.

Student Loan Rehabilitation For Default Repayment Options

Student Loan Rehabilitation For Default Repayment Options

Request help with your private student loan repayment 2. How to Recover From Defaulted Student Loans Step 1. Defaulted student loans become collection accounts. After becoming delinquent 30 days after your payment due date you become officially on a direct path toward defaulting. This will stop you from qualifying for credit cards cars and a home for at least three years. The fastest way to remove defaulted student loans is by disputing.

You can contact a settlement agency to assist you in the process.

The timeframe and causes for sending your private student loans into default depend on the lender. The two main ways to get out of default are loan rehabilitation and loan consolidation. I chose to rehabilitate my loan. Refinance the private student loan 3. Repayment consolidation and rehabilitation. Request help with your private student loan repayment 2.

Your credit utilization makes up 30 of your credit score so if you have other debts like. Request help with your private student loan repayment 2. There are typically three options for getting out of default. If your defaulted student loan has been placed with a collection agency youre on the hook for paying those costs as well. After becoming delinquent 30 days after your payment due date you become officially on a direct path toward defaulting.

In order to repair your credit you need to get out of student loan default first. With most loans the first step will be agreeing on a lump sum settlement for your current student loans. You can contact a settlement agency to assist you in the process. There are typically three options for getting out of default. Most importantly youll need other non-defaulted student loans that you can consolidate your defaulted loan with.

These collection accounts will lower your score up to 100 points. They will demanding payment for their cost and on the loans themselves. Getting Out of Default. For federal student loans a borrower isnt considered to. How to Recover From Defaulted Student Loans Step 1.

1 pay the debt off in full 2 consolidate your student loans and begin making payments or 3 rehabilitate your loans. Consolidate the loans Enter a loan rehabilitation program. The timeframe and causes for sending your private student loans into default depend on the lender. If your defaulted student loan has been placed with a collection agency youre on the hook for paying those costs as well. Now in order to get your student loans out of default you have four options.

You do not have to pay the loan off in full to avoid Treasury offset. You will need to either apply for an income-based repayment schedule on your new consolidated loan OR make three consecutive monthly payments on the defaulted loan before you can consolidate it. I chose to rehabilitate my loan. Altering the terms of a private loan is much different from doing the same with a federal loan. The two main ways to get out of default are loan rehabilitation and loan consolidation.

Wage garnishment sounds scary but the good news is that you can potentially avoid that and other harsh consequences by dealing with your private student loan default right away. Defaulted student loans become collection accounts. How to Recover From Defaulted Student Loans Step 1. You do not have to pay the loan off in full to avoid Treasury offset. Refinance the private student loan 3.

Request help with your private student loan repayment 2. You should contact them as soon as possible to find out whether they will accept a new payment arrangement. Your credit utilization makes up 30 of your credit score so if you have other debts like. Refinance the private student loan 3. After becoming delinquent 30 days after your payment due date you become officially on a direct path toward defaulting.

Four Options to Cure a Defaulted Student Loan. Altering the terms of a private loan is much different from doing the same with a federal loan. Defaulted student loans become collection accounts. There are typically three options for getting out of default. Request help with your private student loan repayment 2.

The timeframe and causes for sending your private student loans into default depend on the lender. The timeframe and causes for sending your private student loans into default depend on the lender. To find out exactly what events will put your loan into default its important to read your contract. I chose to rehabilitate my loan. Altering the terms of a private loan is much different from doing the same with a federal loan.

A collection agency will be given the rights to the debt. In order to repair your credit you need to get out of student loan default first. There are typically three options for getting out of default. Most importantly youll need other non-defaulted student loans that you can consolidate your defaulted loan with. If you have other sources of debt you may settle all your debt at once.

Repayment consolidation and rehabilitation. Request help with your private student loan repayment 2. The fastest way to remove defaulted student loans is by disputing. To find out exactly what events will put your loan into default its important to read your contract. Heres what to do.

You will need to either apply for an income-based repayment schedule on your new consolidated loan OR make three consecutive monthly payments on the defaulted loan before you can consolidate it. In order to repair your credit you need to get out of student loan default first. This will stop you from qualifying for credit cards cars and a home for at least three years. Student loan default occurs after 270 days past due. If your defaulted student loan has been placed with a collection agency youre on the hook for paying those costs as well.

Request help with your private student loan repayment 2. Consolidate the loans Enter a loan rehabilitation program. For federal student loans a borrower isnt considered to. After becoming delinquent 30 days after your payment due date you become officially on a direct path toward defaulting. These collection accounts will lower your score up to 100 points.

1 pay the debt off in full 2 consolidate your student loans and begin making payments or 3 rehabilitate your loans. The fastest way to remove defaulted student loans is by disputing. One way to get out of default is to repay the defaulted loan in full but thats not a practical option for most borrowers. Getting Out of Default. Defaulted student loans become collection accounts.

This will stop you from qualifying for credit cards cars and a home for at least three years. Your credit utilization makes up 30 of your credit score so if you have other debts like. Heres what to do. Defaulted student loans become collection accounts. This will stop you from qualifying for credit cards cars and a home for at least three years.

Getting Out of Default. How to Recover From Defaulted Student Loans Step 1. They will demanding payment for their cost and on the loans themselves. Now in order to get your student loans out of default you have four options. Heres what to do.

You do not have to pay the loan off in full to avoid Treasury offset. If you have other sources of debt you may settle all your debt at once. Consolidate the loans Enter a loan rehabilitation program. While loan rehabilitation takes several months to complete you can quickly apply for loan consolidation. Pay Off Other Debts.

In order to repair your credit you need to get out of student loan default first. The two main ways to get out of default are loan rehabilitation and loan consolidation. You do not have to pay the loan off in full to avoid Treasury offset. Wage garnishment sounds scary but the good news is that you can potentially avoid that and other harsh consequences by dealing with your private student loan default right away. The fastest way to remove defaulted student loans is by disputing.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to fix defaulted private student loans by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.