Your Government backed private student loans images are available. Government backed private student loans are a topic that is being searched for and liked by netizens today. You can Get the Government backed private student loans files here. Get all royalty-free images.

If you’re looking for government backed private student loans pictures information connected with to the government backed private student loans topic, you have pay a visit to the right site. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Government Backed Private Student Loans. If that makes you mad theres a suggestion box somewhere in Washington where you can deposit your complaint. All private student loans are no longer legally collectible once they have expired under the statute of limitations in your state. Private student loans dont have many of the relief provisions allowed for by federal student loans. Since its creation it has backed more than 31 million students with loans.

When It Comes Time To Study For An Exam Most College Students Are Huge Procrastinators And Will Try To Cram The Nigh Study Tips College Night Before Exam Exam

When It Comes Time To Study For An Exam Most College Students Are Huge Procrastinators And Will Try To Cram The Nigh Study Tips College Night Before Exam Exam

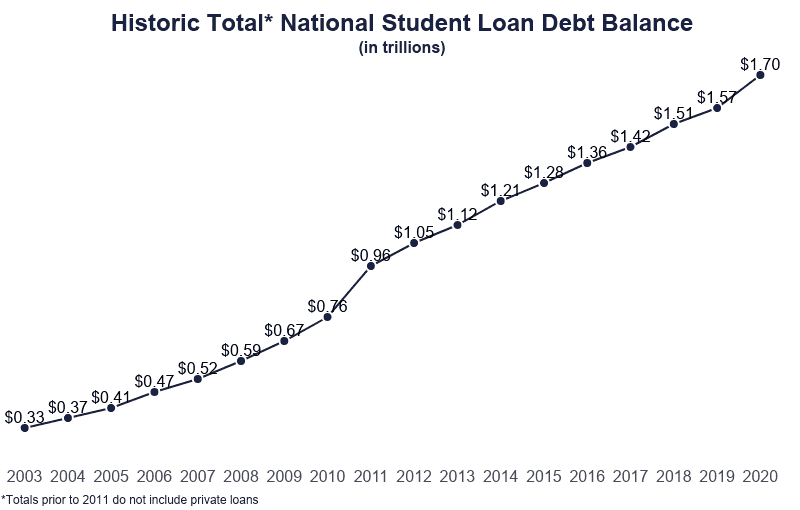

So any student loan you see for Chase Citi Discover or Wells Fargo is most likely a private student loan. Private student loans are consumer loans made to individuals to help pay for college. The Student Loan Debt Clock tells us the current total is over 15 trillion. Federal Student Aid. Only borrow what is needed to. Its no wonder the feedback on Facebook was so negative.

Up until 1993 the federal government merely guaranteedbacked student loans that private lenders gave.

Sallie Mae was originally a government-sponsored entity that was established in 1972 but as of 1997 the company began privatizing its services. Student loans did not exist in their present form until the federal government passed the Higher Education Act of 1965 which had taxpayers guaranteeing loans made by private lenders to students. They are provided by for-profit and nonprofit lending organizations and are not backed by the federal government. Some FFELP Loans are owned by the federal government. Federal loans whether through a bankprivate lender or the Department of Education are funded and regulated by the federal government. The Higher Education Reconciliation Act reduces loan fees from 4 to 1 and allows graduate students to take out PLUS Loans.

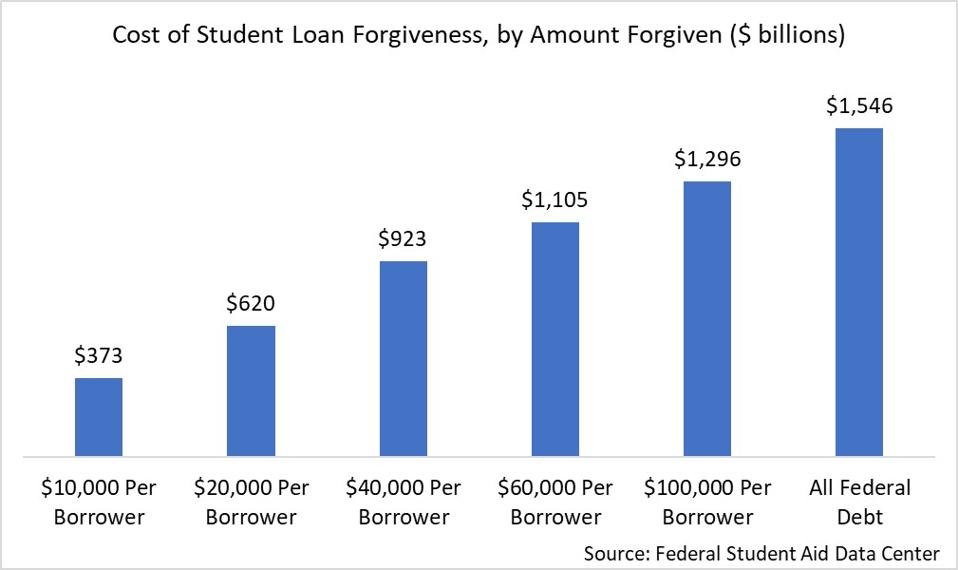

If all student loan debt were forgiven the cost would be approximately 10870 per taxpayer. On the flip side NelNet Great Lakes Mohela and FedLoan Servicing are almost always federal loan servicers although NelNet has begun to acquire private loan porftolios in. Private student loans are consumer loans made to individuals to help pay for college. Private loans are also known as private-label or alternative loans. This meant that only in the case of someone defaulting on their loan would the government be on the hook stepping in and paying the college whats owed.

Federal Student Aid. The Problem with Government-Backed Student Loans. So to the broad and general question of whether or not the US. Up until 1993 the federal government merely guaranteedbacked student loans that private lenders gave. Private loans are also known as private-label or alternative loans.

Private student loans are designed to supplement not replace other financial aid sources to fill funding gaps. So to the broad and general question of whether or not the US. Private student loans are designed to supplement not replace other financial aid sources to fill funding gaps. However prior to 2010 FFELP loans were issued by financial institutions such as banks and guaranteed by the federal government. Under this program the government can now directly lend to student loan borrowers instead of through a private institution which had been the only system since 1965 FFELP.

Private student loans are loans extended by private lenders that are not backed by the federal government. Private student loans have also been excluded from federal relief programs such as the CARES Act which suspended federal student loan payments interest and collections in. Private student loans are designed to supplement not replace other financial aid sources to fill funding gaps. On the flip side NelNet Great Lakes Mohela and FedLoan Servicing are almost always federal loan servicers although NelNet has begun to acquire private loan porftolios in. If that makes you mad theres a suggestion box somewhere in Washington where you can deposit your complaint.

Student loans did not exist in their present form until the federal government passed the Higher Education Act of 1965 which had taxpayers guaranteeing loans made by private lenders to students. If all student loan debt were forgiven the cost would be approximately 10870 per taxpayer. If that makes you mad theres a suggestion box somewhere in Washington where you can deposit your complaint. While the program might have had good intentions it has had unforeseen harmful consequences. They are provided by for-profit and nonprofit lending organizations and are not backed by the federal government.

If that makes you mad theres a suggestion box somewhere in Washington where you can deposit your complaint. Unlike federal student loans that have no statute of limitations private student loans are not guaranteed by the government and can fall under the rules of each state. If that makes you mad theres a suggestion box somewhere in Washington where you can deposit your complaint. Most private student loans are backed by the financial services company called Sallie Mae. Federal loans whether through a bankprivate lender or the Department of Education are funded and regulated by the federal government.

Federal Student Aid. However prior to 2010 FFELP loans were issued by financial institutions such as banks and guaranteed by the federal government. Private loans are also known as private-label or alternative loans. They are provided by for-profit and nonprofit lending organizations and are not backed by the federal government. The Higher Education Reconciliation Act reduces loan fees from 4 to 1 and allows graduate students to take out PLUS Loans.

All private student loans are no longer legally collectible once they have expired under the statute of limitations in your state. So to the broad and general question of whether or not the US. Private student loans dont have many of the relief provisions allowed for by federal student loans. Banks and other financial institutions make private student loans without any direct financial backing from the federal government. Some FFELP Loans are owned by the federal government.

Under this program the government can now directly lend to student loan borrowers instead of through a private institution which had been the only system since 1965 FFELP. Federal Student Aid. These loans are only to be used for qualified educational expenses. Its no wonder the feedback on Facebook was so negative. If all student loan debt were forgiven the cost would be approximately 10870 per taxpayer.

Private student loans dont have many of the relief provisions allowed for by federal student loans. Only borrow what is needed to. Private student loans are designed to supplement not replace other financial aid sources to fill funding gaps. Private student loans have also been excluded from federal relief programs such as the CARES Act which suspended federal student loan payments interest and collections in. Most private student loans are backed by the financial services company called Sallie Mae.

The Higher Education Reconciliation Act reduces loan fees from 4 to 1 and allows graduate students to take out PLUS Loans. Student loans did not exist in their present form until the federal government passed the Higher Education Act of 1965 which had taxpayers guaranteeing loans made by private lenders to students. Private loans are also known as private-label or alternative loans. The Student Loan Debt Clock tells us the current total is over 15 trillion. If all student loan debt were forgiven the cost would be approximately 10870 per taxpayer.

However prior to 2010 FFELP loans were issued by financial institutions such as banks and guaranteed by the federal government. So to the broad and general question of whether or not the US. Student loans did not exist in their present form until the federal government passed the Higher Education Act of 1965 which had taxpayers guaranteeing loans made by private lenders to students. This meant that only in the case of someone defaulting on their loan would the government be on the hook stepping in and paying the college whats owed. Up until 1993 the federal government merely guaranteedbacked student loans that private lenders gave.

However prior to 2010 FFELP loans were issued by financial institutions such as banks and guaranteed by the federal government. They are provided by for-profit and nonprofit lending organizations and are not backed by the federal government. Its no wonder the feedback on Facebook was so negative. Sallie Mae was originally a government-sponsored entity that was established in 1972 but as of 1997 the company began privatizing its services. Since its creation it has backed more than 31 million students with loans.

All private student loans are no longer legally collectible once they have expired under the statute of limitations in your state. While the program might have had good intentions it has had unforeseen harmful consequences. All private student loans are no longer legally collectible once they have expired under the statute of limitations in your state. Student loans did not exist in their present form until the federal government passed the Higher Education Act of 1965 which had taxpayers guaranteeing loans made by private lenders to students. Most private student loans are backed by the financial services company called Sallie Mae.

The Higher Education Reconciliation Act reduces loan fees from 4 to 1 and allows graduate students to take out PLUS Loans. So any student loan you see for Chase Citi Discover or Wells Fargo is most likely a private student loan. Only borrow what is needed to. Federal Student Aid. Private loans are also known as private-label or alternative loans.

On the flip side NelNet Great Lakes Mohela and FedLoan Servicing are almost always federal loan servicers although NelNet has begun to acquire private loan porftolios in. The Problem with Government-Backed Student Loans. The Student Loan Debt Clock tells us the current total is over 15 trillion. Most private student loans are backed by the financial services company called Sallie Mae. So to the broad and general question of whether or not the US.

Federal loans whether through a bankprivate lender or the Department of Education are funded and regulated by the federal government. Private student loans are designed to supplement not replace other financial aid sources to fill funding gaps. Private loans are also known as private-label or alternative loans. So any student loan you see for Chase Citi Discover or Wells Fargo is most likely a private student loan. Its no wonder the feedback on Facebook was so negative.

Its no wonder the feedback on Facebook was so negative. Some FFELP Loans are owned by the federal government. If all student loan debt were forgiven the cost would be approximately 10870 per taxpayer. Under this program the government can now directly lend to student loan borrowers instead of through a private institution which had been the only system since 1965 FFELP. Federal loans whether through a bankprivate lender or the Department of Education are funded and regulated by the federal government.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title government backed private student loans by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.