Your First time home buyer student loan debt images are ready in this website. First time home buyer student loan debt are a topic that is being searched for and liked by netizens now. You can Find and Download the First time home buyer student loan debt files here. Get all free images.

If you’re looking for first time home buyer student loan debt images information related to the first time home buyer student loan debt keyword, you have come to the right blog. Our site always gives you suggestions for seeking the highest quality video and image content, please kindly search and find more enlightening video content and images that fit your interests.

First Time Home Buyer Student Loan Debt. While one may associate student loan debt with recent grads the New York Feds figures show that it has become a lingering problem. If you choose to sell or refinance the property within 5 years the remainder of the student debt loan will be due upon the sale of your home. The loan is forgivable over 5 years. Youre required to pay mortgage insurance.

Buying A House With Student Loan Debt Lendedu Real Estate Investing Real Estate Estate Agent

Buying A House With Student Loan Debt Lendedu Real Estate Investing Real Estate Estate Agent

If you choose to sell or refinance the property within 5 years the remainder of the student debt loan will be due upon the sale of your home. A home loan backed by the Federal Housing Administration FHA could be a great fit for first-time homebuyers and repeat buyers with less-than-stellar credit and little cash savings. In fact plenty of Americans do it every year. Yet so many of these dreamers feel held back by student loan debt. Despite having debt its still possible not only to get approved for a mortgage but to afford monthly payments while still paying off college debt. In general all loan programs required deferred student loan debts counted when underwriters calculate DTI.

Its common for first-time homebuyers to have student loan debt when purchasing a house.

When buying a home your debt-to-income ratio is more important than the total amount you owe. To examine the impact of student loan debt on house-buying power we first look at the median household income of a prospective first-time home buyer who is by definition a renter. This was done by taking 10 of the student loan balance and use that figure as a monthly hypothetical debt. First take a look at your DTI ratio. Keep reading to learn how you can manage student loan debt and still get approved for a mortgage. Student loan debt makes this part of the homebuying process even harder.

Freddie Mac will now requires us to count either your Student Loan payment OR 5 of the balance which ever is higher This is a change from the current guideline that allows us to consider the payment that is reported to the Credit Bureau. Waller PhD professor of. However unreliable income or payments may make up a. Fannie Mae is now effective January of 2018 the only alternative for those who are buying a house with student loan debt in IBR Status. One of the main drivers preventing first-time homebuyers from entering the real estate market and taking advantage of historically low mortgage rates is high debt loads mainly thanks to substantial student loan debts.

However student loan debt has different impacts on home buying. There are some new guidelines effective September 23 2019 for First Time Home Buyers with Student Loan Debt. One of the main drivers preventing first-time homebuyers from entering the real estate market and taking advantage of historically low mortgage rates is high debt loads mainly thanks to substantial student loan debts. Many Americans are forced to delay owning a home because of the burden of monthly student loan. While one may associate student loan debt with recent grads the New York Feds figures show that it has become a lingering problem.

So should you pay off your student loans before you buy a home. One of the main drivers preventing first-time homebuyers from entering the real estate market and taking advantage of historically low mortgage rates is high debt loads mainly thanks to substantial student loan debts. In fact according to LendEDUs average student loan debt statistics there is 152 trillion in outstanding student loan debt in the United StatesHomeownership rates on the other hand are fallingparticularly among millennials. Keep reading to learn how you can manage student loan debt and still get approved for a mortgage. However unreliable income or payments may make up a.

If you choose to sell or refinance the property within 5 years the remainder of the student debt loan will be due upon the sale of your home. A home loan backed by the Federal Housing Administration FHA could be a great fit for first-time homebuyers and repeat buyers with less-than-stellar credit and little cash savings. I want to buy a house but I have debt. To find out more about how student loan debt is impacting first-time homebuyers and what can be done about it we interviewed Bennie D. First-time buyers are often younger then the general home-buying population that typically means less work experience lower income levels and less money saved for down payment.

Freddie Mac will now requires us to count either your Student Loan payment OR 5 of the balance which ever is higher This is a change from the current guideline that allows us to consider the payment that is reported to the Credit Bureau. Student loan debt makes this part of the homebuying process even harder. To find out more about how student loan debt is impacting first-time homebuyers and what can be done about it we interviewed Bennie D. Since outstanding student loan debt wont necessarily keep you from buying your first house you should get pre-approved for a loan before you start your house search. First take a look at your DTI ratio.

This was done by taking 10 of the student loan balance and use that figure as a monthly hypothetical debt. The average first-time home buyer in 2018 had 30000 in student loan debt NAR reports. There are new First Time Home Buyers with Student Loan Debts Mortgage Guidelines that took effect on September 23rd 2019. One of the main drivers preventing first-time homebuyers from entering the real estate market and taking advantage of historically low mortgage rates is high debt loads mainly thanks to substantial student loan debts. Waller PhD professor of.

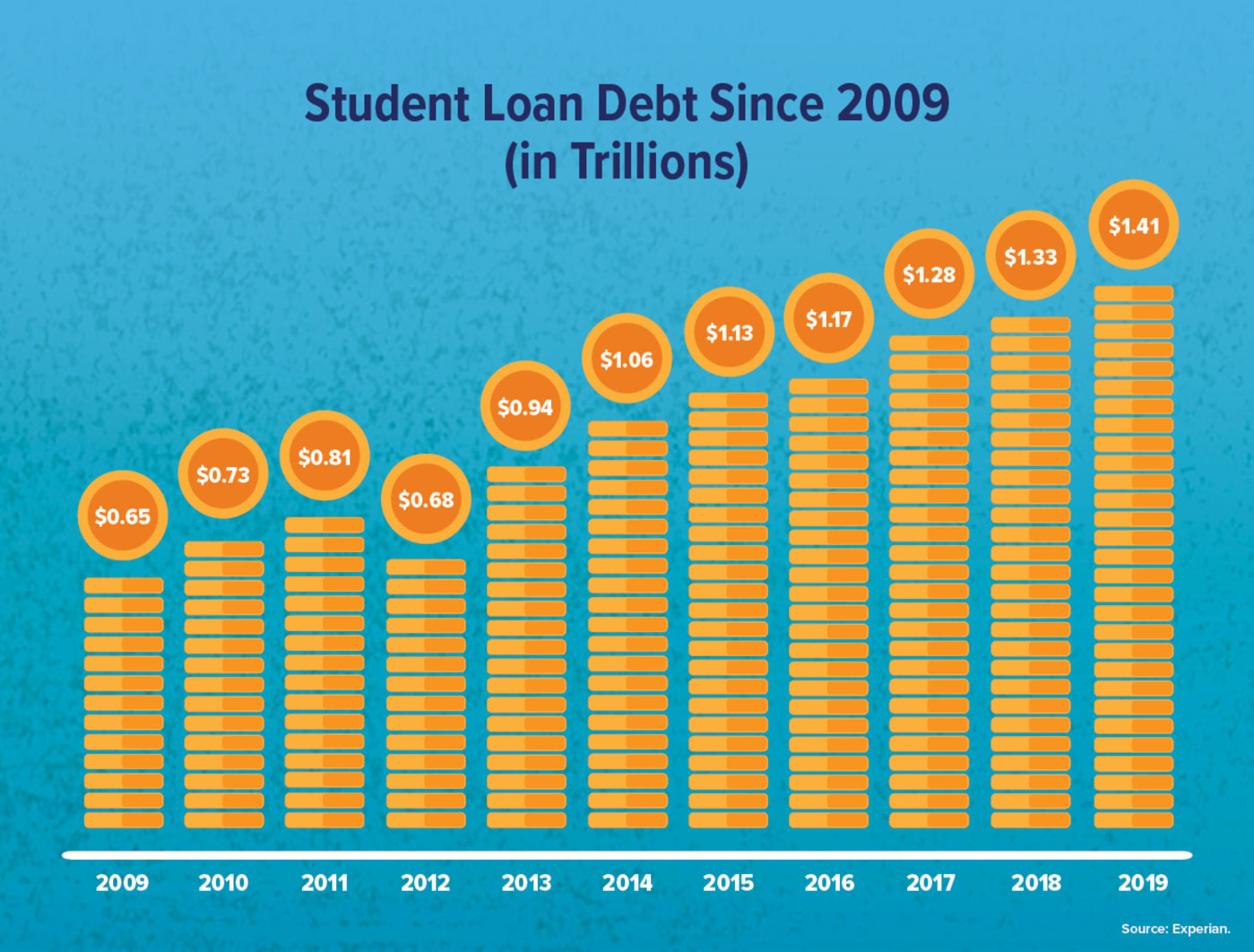

Youre required to pay mortgage insurance. Student loan debt is rising at a troubling rate. Lenders care less about the dollar amount of debt that you have and more about how that debt compares to your total income. When buying a home your debt-to-income ratio is more important than the total amount you owe. The average amount of student-loan debt by a 2017 graduate is more than 37000.

One of the main drivers preventing first-time homebuyers from entering the real estate market and taking advantage of historically low mortgage rates is high debt loads mainly thanks to substantial student loan debts. Yet so many of these dreamers feel held back by student loan debt. There are some new guidelines effective September 23 2019 for First Time Home Buyers with Student Loan Debt. I want to buy a house but I have debt. You can still buy a home with student debt if you have a solid reliable income and a handle on your payments.

In fact according to LendEDUs average student loan debt statistics there is 152 trillion in outstanding student loan debt in the United StatesHomeownership rates on the other hand are fallingparticularly among millennials. Keep reading to learn how you can manage student loan debt and still get approved for a mortgage. However student loan debt has different impacts on home buying. However unreliable income or payments may make up a. I want to buy a house but I have debt.

This includes the payment for the new home plus all other debt reporting to a credit bureau. Yet so many of these dreamers feel held back by student loan debt. Fannie Mae is now effective January of 2018 the only alternative for those who are buying a house with student loan debt in IBR Status. Student Loans and House-Buying Power. This includes the payment for the new home plus all other debt reporting to a credit bureau.

The borrowing requirements for FHA loans arent as stringent as those for conventional loans you just need a minimum 500 credit score to qualify. Keep reading to learn how you can manage student loan debt and still get approved for a mortgage. However unreliable income or payments may make up a. If you choose to sell or refinance the property within 5 years the remainder of the student debt loan will be due upon the sale of your home. The borrowing requirements for FHA loans arent as stringent as those for conventional loans you just need a minimum 500 credit score to qualify.

This was done by taking 10 of the student loan balance and use that figure as a monthly hypothetical debt. Keep reading to learn how you can manage student loan debt and still get approved for a mortgage. Lenders care less about the dollar amount of debt that you have and more about how that debt compares to your total income. Reporting as of March 2020 shows that 86 percent of younger millennialsGen Yers buyers 22 to 29 years and 52 of older millennialsGen Yers buyers 30 to 39 years were first-time home buyers more than other age groups according to the NAR report. When buying a home your debt-to-income ratio is more important than the total amount you owe.

There are new First Time Home Buyers with Student Loan Debts Mortgage Guidelines that took effect on September 23rd 2019. So should you pay off your student loans before you buy a home. You can still buy a home with student debt if you have a solid reliable income and a handle on your payments. While the typical student loan borrower owes between 10000 and 25000 the New York Federal Reserve Bank reports that over 7 million Americans owe more than 50000 in student loans. The loan is forgivable over 5 years.

This means if you live in your home for 5 years your debt is forgiven repayment is not needed. In many cases it also can mean higher levels of federal student loans and debt. The loan is forgivable over 5 years. First-time buyers are often younger then the general home-buying population that typically means less work experience lower income levels and less money saved for down payment. In general all loan programs required deferred student loan debts counted when underwriters calculate DTI.

Freddie Debt to Income Ratio Requirements Freddie Mac now allows for a total ratio of 50. Student loan debt makes this part of the homebuying process even harder. First-time buyers are often younger then the general home-buying population that typically means less work experience lower income levels and less money saved for down payment. First take a look at your DTI ratio. A home loan backed by the Federal Housing Administration FHA could be a great fit for first-time homebuyers and repeat buyers with less-than-stellar credit and little cash savings.

First take a look at your DTI ratio. You can still buy a home with student debt if you have a solid reliable income and a handle on your payments. Fannie Mae is now effective January of 2018 the only alternative for those who are buying a house with student loan debt in IBR Status. Student loan debt is rising at a troubling rate. A home loan backed by the Federal Housing Administration FHA could be a great fit for first-time homebuyers and repeat buyers with less-than-stellar credit and little cash savings.

A variety of mortgage options exist for homebuyers with student loan debt. A home loan backed by the Federal Housing Administration FHA could be a great fit for first-time homebuyers and repeat buyers with less-than-stellar credit and little cash savings. Freddie Debt to Income Ratio Requirements Freddie Mac now allows for a total ratio of 50. There are new First Time Home Buyers with Student Loan Debts Mortgage Guidelines that took effect on September 23rd 2019. If you choose to sell or refinance the property within 5 years the remainder of the student debt loan will be due upon the sale of your home.

But while student loan payments can make it harder to save for a down payment on a home they shouldnt stop you from pursuing your dream of homeownership. Despite having debt its still possible not only to get approved for a mortgage but to afford monthly payments while still paying off college debt. This means if you live in your home for 5 years your debt is forgiven repayment is not needed. This is a great program to utilize if you are a first-time homebuyer. In fact plenty of Americans do it every year.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title first time home buyer student loan debt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.