Your Does bankruptcy clear student loan debt images are ready in this website. Does bankruptcy clear student loan debt are a topic that is being searched for and liked by netizens now. You can Download the Does bankruptcy clear student loan debt files here. Find and Download all free images.

If you’re searching for does bankruptcy clear student loan debt images information connected with to the does bankruptcy clear student loan debt interest, you have come to the right site. Our website always provides you with hints for seeking the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Does Bankruptcy Clear Student Loan Debt. This process is an excellent way of wiping out unsecured credit card debt medical bills overdue utility bills personal loans gym contracts and so on. Filing for bankruptcy also automatically protects you from collection actions on all of your debts at least until the bankruptcy case is resolved or until the creditor gets permission from the court to start collecting again. In fact some bankruptcy lawyers argue that the legal code surrounding bankruptcy and student loans is being misinterpreted. Reviewed by Attorney Andrea Wimmer.

This Chart Shows You Which Cases Allow For Student Loan Cancellation And Forgiveness Student Loans Student Loan Forgiveness Scholarships For College

This Chart Shows You Which Cases Allow For Student Loan Cancellation And Forgiveness Student Loans Student Loan Forgiveness Scholarships For College

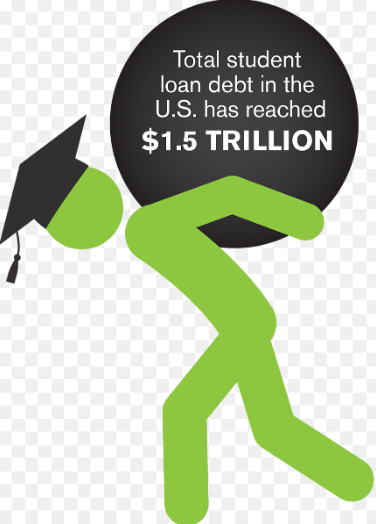

To discharge your student loan debt through bankruptcy you have to prove that you cant pay back your student loans without it having an extremely negative impact on. Federal and private student loan debt surpassed credit card debt for the first time in 2010 and is expected to hit 1 trillion this year. This process is an excellent way of wiping out unsecured credit card debt medical bills overdue utility bills personal loans gym contracts and so on. The bankruptcy code treats student loan debt differently from most other forms of consumer debt such as credit cards and medical bills. To determine whether such a hardship exists the bankruptcy courts conduct an analysis known as the Brunner test. Its a common notion that bankruptcy wont clear student loan debt however there are some states relaxing that stance and even rumors that lawmakers will make it easier to discharge student loans in bankruptcy.

It is not clear how many of the bankruptcies were overseas debtors applying specifically to wipe their student loan debt.

In fact some bankruptcy lawyers argue that the legal code surrounding bankruptcy and student loans is being misinterpreted. However if you can prove that repaying your student loans would cause an undue hardship to you you can get rid of your student loans. Written by Amy Carst. Its a common notion that bankruptcy wont clear student loan debt however there are some states relaxing that stance and even rumors that lawmakers will make it easier to discharge student loans in bankruptcy. At the same time as college graduates are experiencing record-high debt they are offered little opportunity to get back on track. If you are looking for relief from student loan debt a bankruptcy or consumer proposal can eliminate certain student debt.

Plus even a successful discharge of student loan debt carries the long-term effects of a bankruptcy on your credit. Filing for bankruptcy also automatically protects you from collection actions on all of your debts at least until the bankruptcy case is resolved or until the creditor gets permission from the court to start collecting again. Student loans are some of the loans eligible to file for a bankruptcy case. It is not clear how many of the bankruptcies were overseas debtors applying specifically to wipe their student loan debt. However if you can prove that repaying your student loans would cause an undue hardship to you you can get rid of your student loans.

Written by Amy Carst. Plus even a successful discharge of student loan debt carries the long-term effects of a bankruptcy on your credit. Filing for bankruptcy also automatically protects you from collection actions on all of your debts at least until the bankruptcy case is resolved or until the creditor gets permission from the court to start collecting again. At the same time as college graduates are experiencing record-high debt they are offered little opportunity to get back on track. The process to Getting Private Banks Student Loan Cleared Through Filing for Bankruptcy.

Basically itll handle all your unsecured debt. Credit card debt. To discharge your student loan debt through bankruptcy you have to prove that you cant pay back your student loans without it having an extremely negative impact on. Under the current Bankruptcy Code an individual cannot discharge student loans in bankruptcy unless retaining this type of student debt would cause undue hardship. To determine whether such a hardship exists the bankruptcy courts conduct an analysis known as the Brunner test.

In fact some bankruptcy lawyers argue that the legal code surrounding bankruptcy and student loans is being misinterpreted. Does bankruptcy clear student loan debt. If you are looking for relief from student loan debt a bankruptcy or consumer proposal can eliminate certain student debt. Typically student loans are not eligible for discharge. Basically itll handle all your unsecured debt.

However there are exceptions to what types of debts are eligible for discharge. It is not clear how many of the bankruptcies were overseas debtors applying specifically to wipe their student loan debt. Its a common notion that bankruptcy wont clear student loan debt however there are some states relaxing that stance and even rumors that lawmakers will make it easier to discharge student loans in bankruptcy. The bankruptcy code treats student loan debt differently from most other forms of consumer debt such as credit cards and medical bills. Its no surprise that student loan debt is a major concern.

Student loans are some of the loans eligible to file for a bankruptcy case. An Adversarial Proceeding is a lawsuit filed within the bankruptcy court. However there are exceptions to what types of debts are eligible for discharge. Federal and private student loan debt surpassed credit card debt for the first time in 2010 and is expected to hit 1 trillion this year. Typically student loans are not eligible for discharge.

Filing for bankruptcy also automatically protects you from collection actions on all of your debts at least until the bankruptcy case is resolved or until the creditor gets permission from the court to start collecting again. To discharge your student loan debt through bankruptcy you have to prove that you cant pay back your student loans without it having an extremely negative impact on. As we noted above from a 2011 study just 004 of people who declared bankruptcy and sought to have their loans discharged received a partial or full discharge of student loan debt. At the same time as college graduates are experiencing record-high debt they are offered little opportunity to get back on track. Discharging Student Loan Debt.

This process is an excellent way of wiping out unsecured credit card debt medical bills overdue utility bills personal loans gym contracts and so on. Learn more about bankruptcy and student loans here. Written by Amy Carst. The goal with filing bankruptcy is often to discharge as much debt as possible. An Adversarial Proceeding is a lawsuit filed within the bankruptcy court.

Learn more about bankruptcy and student loans here. Does bankruptcy clear student loan debt. If you are the guarantor and the other person fails to pay it will be included in your bankruptcy and the creditor wont be able to chase you for it. As we noted above from a 2011 study just 004 of people who declared bankruptcy and sought to have their loans discharged received a partial or full discharge of student loan debt. However if you can prove that repaying your student loans would cause an undue hardship to you you can get rid of your student loans.

An Adversarial Proceeding is a lawsuit filed within the bankruptcy court. However if you can prove that repaying your student loans would cause an undue hardship to you you can get rid of your student loans. If you can successfully prove undue hardship your student loan will be completely canceled. Reviewed by Attorney Andrea Wimmer. In fact some bankruptcy lawyers argue that the legal code surrounding bankruptcy and student loans is being misinterpreted.

As we noted above from a 2011 study just 004 of people who declared bankruptcy and sought to have their loans discharged received a partial or full discharge of student loan debt. Plus even a successful discharge of student loan debt carries the long-term effects of a bankruptcy on your credit. If you can successfully prove undue hardship your student loan will be completely canceled. Typically student loans are not eligible for discharge. Written by Amy Carst.

Student loans are some of the loans eligible to file for a bankruptcy case. Its no surprise that student loan debt is a major concern. The bankruptcy code treats student loan debt differently from most other forms of consumer debt such as credit cards and medical bills. Learn more about bankruptcy and student loans here. At the same time as college graduates are experiencing record-high debt they are offered little opportunity to get back on track.

Basically itll handle all your unsecured debt. Heres where bankruptcy really shines. To get a student loan obtained in a private bank cleared through bankruptcy you must file an adversarial proceeding AP. In fact some bankruptcy lawyers argue that the legal code surrounding bankruptcy and student loans is being misinterpreted. Its a common notion that bankruptcy wont clear student loan debt however there are some states relaxing that stance and even rumors that lawmakers will make it easier to discharge student loans in bankruptcy.

Under the current Bankruptcy Code an individual cannot discharge student loans in bankruptcy unless retaining this type of student debt would cause undue hardship. Filing bankruptcy on student loans is possible but youll have to go through a difficult process to do so. This process is an excellent way of wiping out unsecured credit card debt medical bills overdue utility bills personal loans gym contracts and so on. However there are exceptions to what types of debts are eligible for discharge. The bankruptcy code treats student loan debt differently from most other forms of consumer debt such as credit cards and medical bills.

However there are exceptions to what types of debts are eligible for discharge. If you are looking for relief from student loan debt a bankruptcy or consumer proposal can eliminate certain student debt. To get a student loan obtained in a private bank cleared through bankruptcy you must file an adversarial proceeding AP. This process is an excellent way of wiping out unsecured credit card debt medical bills overdue utility bills personal loans gym contracts and so on. It is not clear how many of the bankruptcies were overseas debtors applying specifically to wipe their student loan debt.

At the same time as college graduates are experiencing record-high debt they are offered little opportunity to get back on track. Plus even a successful discharge of student loan debt carries the long-term effects of a bankruptcy on your credit. To determine whether such a hardship exists the bankruptcy courts conduct an analysis known as the Brunner test. Under the current Bankruptcy Code an individual cannot discharge student loans in bankruptcy unless retaining this type of student debt would cause undue hardship. Its no surprise that student loan debt is a major concern.

IRD was not able to immediately provide the breakdown. An Adversarial Proceeding is a lawsuit filed within the bankruptcy court. Filing for bankruptcy also automatically protects you from collection actions on all of your debts at least until the bankruptcy case is resolved or until the creditor gets permission from the court to start collecting again. The process to Getting Private Banks Student Loan Cleared Through Filing for Bankruptcy. Most debtors wont be able to discharge wipe out student loan debt in Chapter 7 or Chapter 13 bankruptcy.

In fact some bankruptcy lawyers argue that the legal code surrounding bankruptcy and student loans is being misinterpreted. Reviewed by Attorney Andrea Wimmer. If you can successfully prove undue hardship your student loan will be completely canceled. Written by Amy Carst. Discharging Student Loan Debt.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does bankruptcy clear student loan debt by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.