Your Discharge private student loans chapter 7 images are ready in this website. Discharge private student loans chapter 7 are a topic that is being searched for and liked by netizens today. You can Get the Discharge private student loans chapter 7 files here. Get all royalty-free vectors.

If you’re searching for discharge private student loans chapter 7 pictures information connected with to the discharge private student loans chapter 7 keyword, you have come to the right site. Our website always gives you hints for viewing the maximum quality video and picture content, please kindly search and locate more informative video content and images that fit your interests.

Discharge Private Student Loans Chapter 7. There are two steps to discharge student loans in chapter 7. She had received scholarships and grants that paid 100 of her education costs including tuition fees and other related expenses. In most Chapter 7 cases a debtor will receive a discharge unless a creditor objects within 60 days from the date the meeting of creditors was scheduled. Ortiz had four loans labeled undergraduate loans.

The Chapter 7 Discharge Chapter 7 Bankruptcy Attorneys Arm Lawyers

The Chapter 7 Discharge Chapter 7 Bankruptcy Attorneys Arm Lawyers

However if you can prove that repaying your student loans would cause an undue hardship to you you can get rid of your student loans. The best reason to file using Chapter 13 is that youll have better options for additional assistance if your request for discharge gets denied during bankruptcy proceedings whereas with a Chapter 7 bankruptcy youll still owe the full amount of your private student loan debt and you wont have any other opportunities to get it reduced. If you owe private student loans for a school that was not accredited your loans can probably be discharged in a Chapter 7 bankruptcy right away. Since Chapter 13 reorganizes rather than wipes out debt the debtor is usually. Appeals court has held that a borrowers 200000 in private student loans are dischargeable in bankruptcy potentially opening the door for similar bankruptcy. To do it you must do two things.

You might qualify for bankruptcy discharge if you file for Chapter 7 or Chapter 13 bankruptcy and a judge rules that paying off your student loans would cause undue hardship.

Bankruptcy courts allow post-discharge adversaries for student loan debt due to the quick deadlines imposed in Chapter 7 proceedings for meetings of creditors. File a chapter 7 bankruptcy case. 3 Qualified higher education expenses A In general. Appeals court has held that a borrowers 200000 in private student loans are dischargeable in bankruptcy potentially opening the door for similar bankruptcy. Like federal student loans private student loans are usually not dischargeable in bankruptcy. In most Chapter 7 cases a debtor will receive a discharge unless a creditor objects within 60 days from the date the meeting of creditors was scheduled.

The first part filing bankruptcy will eliminate your consumer debt. If you owe private student loans for a school that was not accredited your loans can probably be discharged in a Chapter 7 bankruptcy right away. Unfortunately for most of these debtors student loans are not among the debts they will be able to unload. To do it you must do two things. You might qualify for bankruptcy discharge if you file for Chapter 7 or Chapter 13 bankruptcy and a judge rules that paying off your student loans would cause undue hardship.

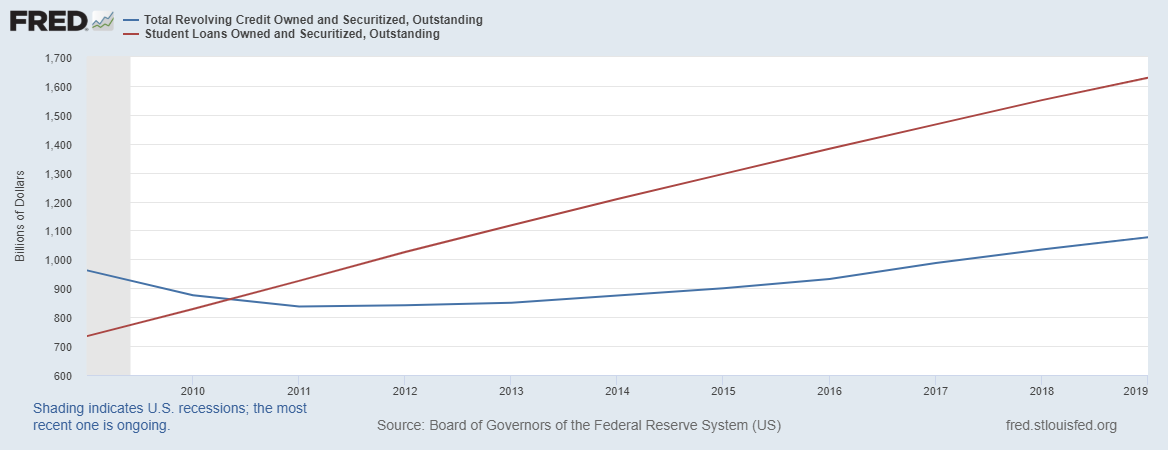

There are two steps to discharge student loans in chapter 7. Since Chapter 13 reorganizes rather than wipes out debt the debtor is usually. In most Chapter 7 cases a debtor will receive a discharge unless a creditor objects within 60 days from the date the meeting of creditors was scheduled. A qualified higher education expense is defined as. Due to their increasing prevalence and the reduced certainty that a college education will result in a better paying job student loans are more and more among the debts that bankruptcy filers hope to discharge in a Chapter 7 bankruptcy.

Student Loans in Chapter 7 or Chapter 13 Bankruptcy Getting rid of student loans in bankruptcy is difficult – but not always impossible. You must prove that you cannot maintain based upon current income and expenses a minimal standard of living for yourself and your dependents if forced to repay the loan. Even some big-time lenders still make private student loans to such unprotected organizations. There are two steps to discharge student loans in chapter 7. If you owe private student loans for a school that was not accredited your loans can probably be discharged in a Chapter 7 bankruptcy right away.

Under Brunner youve got to satisfy three conditions in order to discharge your student loans in a Chapter 7 bankruptcy. Due to their increasing prevalence and the reduced certainty that a college education will result in a better paying job student loans are more and more among the debts that bankruptcy filers hope to discharge in a Chapter 7 bankruptcy. Paying them off would mean you couldnt meet a minimal standard of living. In this situation wherein you are at the mercy of the private lender a non-bankruptcy solution may be better. The best way to reduce or eliminate your private student loans might be a debt settlement.

Student Loans in Chapter 7 or Chapter 13 Bankruptcy Getting rid of student loans in bankruptcy is difficult – but not always impossible. The best way to reduce or eliminate your private student loans might be a debt settlement. Due to their increasing prevalence and the reduced certainty that a college education will result in a better paying job student loans are more and more among the debts that bankruptcy filers hope to discharge in a Chapter 7 bankruptcy. Unfortunately for most of these debtors student loans are not among the debts they will be able to unload. To do it you must do two things.

It is no wonder the question of whether or not student loans can be included in a Chapter 7 bankruptcy comes up all the time. File chapter 7 bankruptcy or chapter 13 bankruptcy in federal court and file an adversary proceeding to discharge your private student loan debt. A major new ruling by a U. In most Chapter 7 cases a debtor will receive a discharge unless a creditor objects within 60 days from the date the meeting of creditors was scheduled. Appeals court has held that a borrowers 200000 in private student loans are dischargeable in bankruptcy potentially opening the door for similar bankruptcy.

Appeals court has held that a borrowers 200000 in private student loans are dischargeable in bankruptcy potentially opening the door for similar bankruptcy. Under Brunner youve got to satisfy three conditions in order to discharge your student loans in a Chapter 7 bankruptcy. Furthermore while you must be able to prove undue hardship to discharge federal and private student loans in a Chapter 7 bankruptcy Chapter 13 bankruptcy may provide other benefits. To succeed you must convince the court that repaying your student loans would cause you undue hardship. In this situation wherein you are at the mercy of the private lender a non-bankruptcy solution may be better.

This case shows if a creditor claims your private student loans are exempt from discharge in bankruptcy that is not always true. However if you can prove that repaying your student loans would cause an undue hardship to you you can get rid of your student loans. This case shows if a creditor claims your private student loans are exempt from discharge in bankruptcy that is not always true. Furthermore while you must be able to prove undue hardship to discharge federal and private student loans in a Chapter 7 bankruptcy Chapter 13 bankruptcy may provide other benefits. Open an adversary proceeding to discharge your student loans as an undue hardship.

Under Brunner youve got to satisfy three conditions in order to discharge your student loans in a Chapter 7 bankruptcy. If your school is on the list some of your private student loans may still be discharged if they were used for expenses that were not qualified higher education expenses That part of the student loan may and should be discharged. Due to their increasing prevalence and the reduced certainty that a college education will result in a better paying job student loans are more and more among the debts that bankruptcy filers hope to discharge in a Chapter 7 bankruptcy. A major new ruling by a U. A qualified higher education expense is defined as.

The best reason to file using Chapter 13 is that youll have better options for additional assistance if your request for discharge gets denied during bankruptcy proceedings whereas with a Chapter 7 bankruptcy youll still owe the full amount of your private student loan debt and you wont have any other opportunities to get it reduced. Student Loans in Chapter 7 or Chapter 13 Bankruptcy Getting rid of student loans in bankruptcy is difficult – but not always impossible. If your school is on the list some of your private student loans may still be discharged if they were used for expenses that were not qualified higher education expenses That part of the student loan may and should be discharged. It would be rare for a debt settlement company to attempt to negotiate a settlement for a private. The first part filing bankruptcy will eliminate your consumer debt.

Paying them off would mean you couldnt meet a minimal standard of living. It is no wonder the question of whether or not student loans can be included in a Chapter 7 bankruptcy comes up all the time. If you owe private student loans for a school that was not accredited your loans can probably be discharged in a Chapter 7 bankruptcy right away. You must prove that you cannot maintain based upon current income and expenses a minimal standard of living for yourself and your dependents if forced to repay the loan. File chapter 7 bankruptcy or chapter 13 bankruptcy in federal court and file an adversary proceeding to discharge your private student loan debt.

3 Qualified higher education expenses A In general. Open an adversary proceeding to discharge your student loans as an undue hardship. Furthermore while you must be able to prove undue hardship to discharge federal and private student loans in a Chapter 7 bankruptcy Chapter 13 bankruptcy may provide other benefits. A major new ruling by a U. File chapter 7 bankruptcy or chapter 13 bankruptcy in federal court and file an adversary proceeding to discharge your private student loan debt.

The best way to reduce or eliminate your private student loans might be a debt settlement. It is no wonder the question of whether or not student loans can be included in a Chapter 7 bankruptcy comes up all the time. In this situation wherein you are at the mercy of the private lender a non-bankruptcy solution may be better. To do it you must do two things. The best way to reduce or eliminate your private student loans might be a debt settlement.

3 Qualified higher education expenses A In general. 3 Qualified higher education expenses A In general. If you owe private student loans for a school that was not accredited your loans can probably be discharged in a Chapter 7 bankruptcy right away. Bankruptcy courts allow post-discharge adversaries for student loan debt due to the quick deadlines imposed in Chapter 7 proceedings for meetings of creditors. The best way to reduce or eliminate your private student loans might be a debt settlement.

If your school is on the list some of your private student loans may still be discharged if they were used for expenses that were not qualified higher education expenses That part of the student loan may and should be discharged. File chapter 7 bankruptcy or chapter 13 bankruptcy in federal court and file an adversary proceeding to discharge your private student loan debt. Appeals court has held that a borrowers 200000 in private student loans are dischargeable in bankruptcy potentially opening the door for similar bankruptcy. If your school is on the list some of your private student loans may still be discharged if they were used for expenses that were not qualified higher education expenses That part of the student loan may and should be discharged. Furthermore while you must be able to prove undue hardship to discharge federal and private student loans in a Chapter 7 bankruptcy Chapter 13 bankruptcy may provide other benefits.

This case shows if a creditor claims your private student loans are exempt from discharge in bankruptcy that is not always true. File chapter 7 bankruptcy or chapter 13 bankruptcy in federal court and file an adversary proceeding to discharge your private student loan debt. Due to their increasing prevalence and the reduced certainty that a college education will result in a better paying job student loans are more and more among the debts that bankruptcy filers hope to discharge in a Chapter 7 bankruptcy. 3 Qualified higher education expenses A In general. Open an adversary proceeding to discharge your student loans as an undue hardship.

Unfortunately for most of these debtors student loans are not among the debts they will be able to unload. To do it you must do two things. Student loans are difficult to discharge in bankruptcy but it is possible. In this situation wherein you are at the mercy of the private lender a non-bankruptcy solution may be better. Currently the government considers your loans an undue hardship if.

The best reason to file using Chapter 13 is that youll have better options for additional assistance if your request for discharge gets denied during bankruptcy proceedings whereas with a Chapter 7 bankruptcy youll still owe the full amount of your private student loan debt and you wont have any other opportunities to get it reduced. You must prove that you cannot maintain based upon current income and expenses a minimal standard of living for yourself and your dependents if forced to repay the loan. To succeed you must convince the court that repaying your student loans would cause you undue hardship. There are two steps to discharge student loans in chapter 7. Ortiz had four loans labeled undergraduate loans.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title discharge private student loans chapter 7 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.