Your Are student loans counted in debt to income ratio images are available. Are student loans counted in debt to income ratio are a topic that is being searched for and liked by netizens today. You can Download the Are student loans counted in debt to income ratio files here. Find and Download all royalty-free vectors.

If you’re searching for are student loans counted in debt to income ratio images information connected with to the are student loans counted in debt to income ratio topic, you have visit the right site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

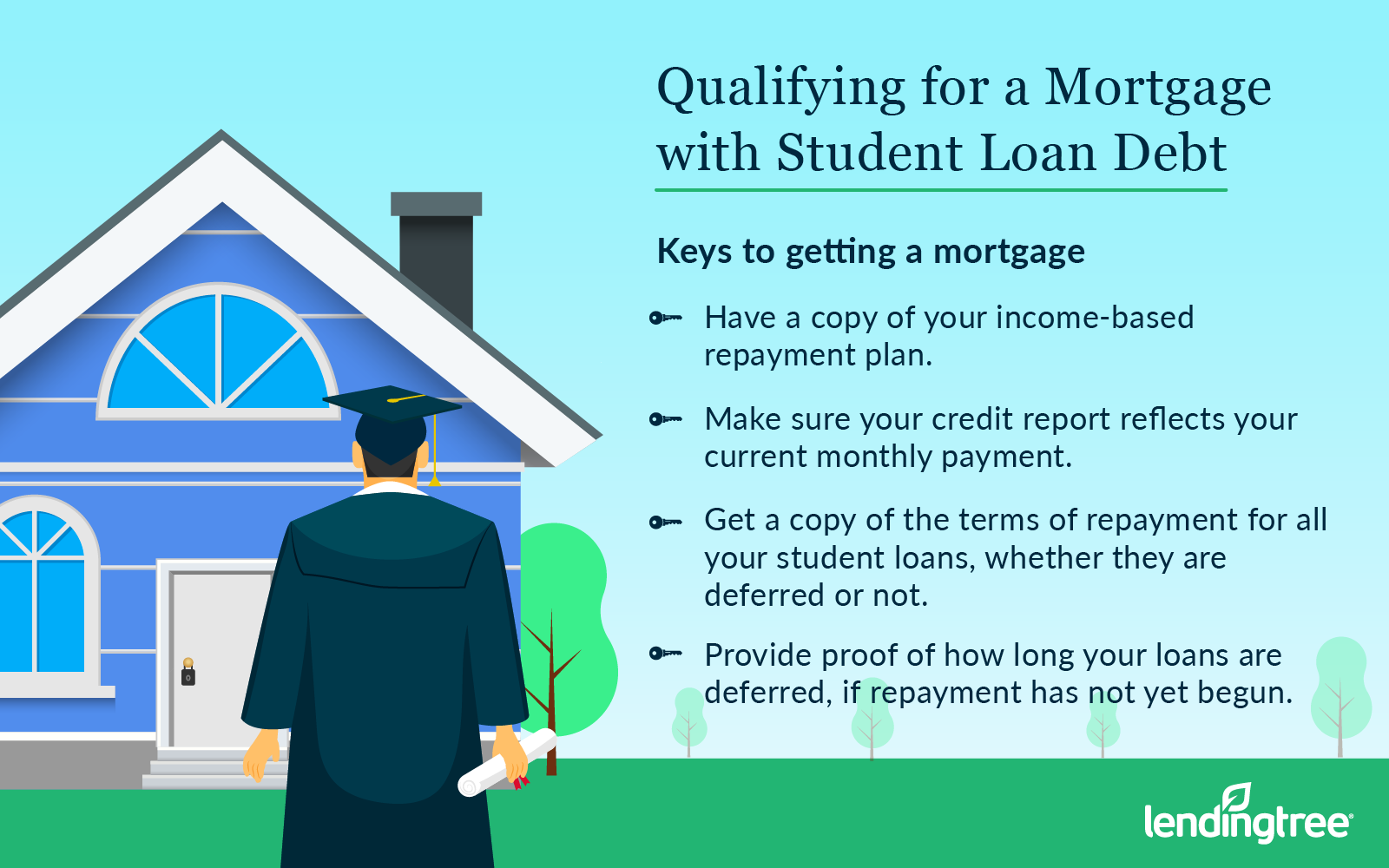

Are Student Loans Counted In Debt To Income Ratio. Of Education which offers a variety or repayment plans and allows you to change them by request. If payments are not being made then lenders might calculate an imputed monthly cost equal to 1 percent of the student loan. Your debt-to-income ratio and student loans. Your DTI ratio is the percentage of your gross monthly income that is dedicated to paying your monthly debt obligations.

How To Calculate Your Debt To Income Ratio Step By Step Mymove

How To Calculate Your Debt To Income Ratio Step By Step Mymove

The DTI ratio considers your gross monthly income compared to your monthly debts. An orthopedist with a student loan burden of 400K and an income of 400K also has a ratio of 1X. Your DTI ratio is the percentage of your gross monthly income that is dedicated to paying your monthly debt obligations. Your total student loan debt should be less than your annual income. The deferment needs to be at least 12 months. The bottom line is that deferred student loans do affect your debt-to-income ratio for every loan except the VA loan if you dont need to make payments for at least 12 months.

Theyll also include your housing payment even if you rent as well as other debt payments and.

Veterans borrowers with deferred student loans are exempt from student loans being counted in debt to income ratio calculations. Veterans borrowers with deferred student loans are exempt from student loans being counted in debt to income ratio calculations. Theyll also include your housing payment even if you rent as well as other debt payments and. Now that you understand what a debt to income ratio is and the importance of it on your mortgage loan application it is critical that you are calculating it correctly. The DTI ratio considers your gross monthly income compared to your monthly debts. Your credit card payments are involved in back end type of costs as well.

Veterans borrowers with deferred student loans are exempt from student loans being counted in debt to income ratio calculations. Ideally you want your outgoing payments including the estimate of new home cost to be at or below 41 percent of your monthly income. Perhaps a better way to look at it is to consider the ratio of student loan debt to peak earning salary. The back end DTI ratio is what you spend for other debt obligations. For student loans it is best to have a student loan debt-to-income ratio that is under 10 with a stretch limit of 15 if you do not have many other types of loans.

The deferment needs to be at least 12 months. My student loans are in repayment and were counted in my debt to income ratio for an FHA loan. FHA loans require the lender to calculate the borrowers debt-to-income ratio to determine if the applicant can realistically afford to make a monthly FHA mortgage payment. The DTI ratio considers your gross monthly income compared to your monthly debts. For example an internist with the average student loan debt of 200K and an income of 200K has a ratio of 1X.

May 14 2014. If you have two children a high school student and university student and both of them are dependants. May 14 2014. Ideally you want your outgoing payments including the estimate of new home cost to be at or below 41 percent of your monthly income. Of Education which offers a variety or repayment plans and allows you to change them by request.

Credit cards auto etc and then your new housing payment ideally these numbers would fall at below 43 percent of your income. The back end DTI ratio is what you spend for other debt obligations. Student loan debt can have a direct effect on your debt-to-income ratio in that the higher your monthly payments the more your ratio can increase. Veterans borrowers with deferred student loans are exempt from student loans being counted in debt to income ratio calculations. How the debt is figured can vary.

If payments are not being made then lenders might calculate an imputed monthly cost equal to 1 percent of the student loan. My loans are direct from the Dept. Credit cards auto etc and then your new housing payment ideally these numbers would fall at below 43 percent of your income. The deferment needs to be at least 12 months. Your debt-to-income ratio and student loans.

Your credit score is just one of the major factors that determine whether you qualify for a mortgage. Student loan debt can have a direct effect on your debt-to-income ratio in that the higher your monthly payments the more your ratio can increase. Its a good thing that lenders do include it though as it can prevent you from taking out a mortgage that you wont be able to afford in the near future. Generally a good rule of thumb for how high your debt ratio can be including your student loan payments is 43. If you have two children a high school student and university student and both of them are dependants.

The back end DTI ratio is what you spend for other debt obligations. Its a good thing that lenders do include it though as it can prevent you from taking out a mortgage that you wont be able to afford in the near future. Your DTI ratio is the percentage of your gross monthly income that is dedicated to paying your monthly debt obligations. The deferment needs to be at least 12 months. Another important number is your debt-to-income DTI ratio.

However student loans need to be deferred for at least 12 months. Generally a good rule of thumb for how high your debt ratio can be including your student loan payments is 43. The back end DTI ratio is what you spend for other debt obligations. Since property taxes and homeowners insurance are included in your mortgage payment theyre counted on your debt-to-income ratio too. Now that you understand what a debt to income ratio is and the importance of it on your mortgage loan application it is critical that you are calculating it correctly.

How the debt is figured can vary. FHA loans require the lender to calculate the borrowers debt-to-income ratio to determine if the applicant can realistically afford to make a monthly FHA mortgage payment. In order to figure out your debt to income ratio correctly you must understand what monthly debt. The bottom line is that deferred student loans do affect your debt-to-income ratio for every loan except the VA loan if you dont need to make payments for at least 12 months. Your debt-to-income ratio and student loans.

Now that you understand what a debt to income ratio is and the importance of it on your mortgage loan application it is critical that you are calculating it correctly. FHA loans require the lender to calculate the borrowers debt-to-income ratio to determine if the applicant can realistically afford to make a monthly FHA mortgage payment. The bottom line is that deferred student loans do affect your debt-to-income ratio for every loan except the VA loan if you dont need to make payments for at least 12 months. Generally a good rule of thumb for how high your debt ratio can be including your student loan payments is 43. Another important number is your debt-to-income DTI ratio.

If payments are not being made then lenders might calculate an imputed monthly cost equal to 1 percent of the student loan. If payments are not being made then lenders might calculate an imputed monthly cost equal to 1 percent of the student loan. How the debt is figured can vary. Your credit score is just one of the major factors that determine whether you qualify for a mortgage. Perhaps a better way to look at it is to consider the ratio of student loan debt to peak earning salary.

The DTI ratio considers your gross monthly income compared to your monthly debts. Perhaps a better way to look at it is to consider the ratio of student loan debt to peak earning salary. The deferment needs to be at least 12 months. If you have two children a high school student and university student and both of them are dependants. For student loans it is best to have a student loan debt-to-income ratio that is under 10 with a stretch limit of 15 if you do not have many other types of loans.

My loans are direct from the Dept. My student loans are in repayment and were counted in my debt to income ratio for an FHA loan. One approach is to simply look at the payments actually being made and have them count in the DTI ratio. For example an internist with the average student loan debt of 200K and an income of 200K has a ratio of 1X. Another important number is your debt-to-income DTI ratio.

The deferment needs to be at least 12 months. Lenders typically count your existing student loan payment in your debt-to-income ratio. Perhaps a better way to look at it is to consider the ratio of student loan debt to peak earning salary. Of Education which offers a variety or repayment plans and allows you to change them by request. The DTI ratio considers your gross monthly income compared to your monthly debts.

The deferment needs to be at least 12 months. However student loans need to be deferred for at least 12 months. My loans are direct from the Dept. This means that when you calculate your student loan payments your other payments ie. In order to figure out your debt to income ratio correctly you must understand what monthly debt.

This means that when you calculate your student loan payments your other payments ie. How the debt is figured can vary. Of Education which offers a variety or repayment plans and allows you to change them by request. To lenders student loans show up as debt and debt is something that has to be considered when figuring the debt-to-income ratio. Your credit card payments are involved in back end type of costs as well.

My student loans are in repayment and were counted in my debt to income ratio for an FHA loan. For student loans it is best to have a student loan debt-to-income ratio that is under 10 with a stretch limit of 15 if you do not have many other types of loans. Ideally you want your outgoing payments including the estimate of new home cost to be at or below 41 percent of your monthly income. Your DTI ratio is the percentage of your gross monthly income that is dedicated to paying your monthly debt obligations. Just like any other debt your student loan will be considered in your debt-to-income DTI ratio.

One approach is to simply look at the payments actually being made and have them count in the DTI ratio. FHA loans require the lender to calculate the borrowers debt-to-income ratio to determine if the applicant can realistically afford to make a monthly FHA mortgage payment. One approach is to simply look at the payments actually being made and have them count in the DTI ratio. Theyll also include your housing payment even if you rent as well as other debt payments and. This means that when you calculate your student loan payments your other payments ie.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title are student loans counted in debt to income ratio by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.